|

You may have read about it: last month, the National Association of Realtors (NAR) has chosen to settle a lawsuit brought by home sellers regarding residential commissions. Lacking objective and correct public media coverage I can’t refer you to a good press article. So here is a summary of what we know per early April, to be updated as needed: If approved by the courts, from July on • Buyer’s agents commissions – the so-called “co-broke” offer – will not be displayed on MLS* listings anymore, • Buyers must sign an agreement when working with a buyer’s agent In detail:

1. Compensation offers must be moved off the MLS by mid-July 2024 In current practice, every residential property on the MLS shows a commission offer to the buyer’s agent. In July, this will disappear. The Effect on Buyers and their Agents If buyer’s agent's commissions are not offered on MLS listings anymore, how will agents know if they receive a commission when bringing a buyer? The way it looks right now, they may have to ask the seller’s agent of every property the buyer is interested in. Since the nationwide settlement does not prevent a buyer’s agent commission from coming from the seller, just as it previously has, it can still be included as part of the seller’s costs in negotiation. For example: a seller could pay a 6% commission, split 3% and 3% to each agent. It just can't be offered as "co-broke" on the MLS. One possible workaround instead, sellers can offer a closing credit equal to the buyer brokers commission. This way, buyers aren't coming out of pocket for commissions. It's still paid out of the purchase price, just written differently. Options However, since a seller paying a buyer’s agent’s commission will no longer be the necessity or 'requirement' it once was, some sellers may not agree to these terms and will only pay the commission of their seller’s agent. Wishful Thinking by the Press, Act I: Sellers, if not offering commission to the buyer’s agent, will lower the prices by the amount they save. – Right. And Elvis Presley just gave birth to triplets. More likely: home prices may see little change overall beyond the usual market trends. Wishful Thinking Act II, floated by many public media outlets, even serious ones such as the NYT: buyer's agents might happily work for no or little money. This hope seems hallucinogenic-induced. Realistic it is not. However, it will be possible to negotiate commissions – just as it is now already. Commissions have never been dictated; long before this settlement they already were entirely negotiable between brokers and their clients. And housing prices are dictated by market forces – beyond Realtors’ control. ...and their Results So if a buyer’s agent’s commission is not paid by the seller, responsibility will fall on the buyer. For some prospective buyers in the market, this creates a new affordability barrier to home ownership in an already expensive market such as South Florida. If a buyer can't cover the buyer’s agent’s fee (or doesn't want to), no agent will work with that buyer. As a result, some buyers may try move forward in the market without an agent. But: besides not having access to the MLS database with its full search options and myriad filter capabilities (e.g.: "bedroom on the ground floor") , there are just a few drawbacks to foregoing professional assistance in what is typically the biggest investment a person makes in his/her life: No explaining the purchase process, no area and property selection, no market analysis, no contract guidance, no offer-writing, no price negotiation skills, no contract timeline supervision, no recommendations for building inspectors and trades, no coaching with paperwork, no closing assistance and no after-closing support. You get the idea. 2. A Written Agreement becomes Mandatory for Buyers Up to now, Florida was one of the few states that did not require a mandatory buyer’s broker agreement. This will change for residential transactions nationwide if a buyer wants to work with an agent (versus finding a property and acquiring it without a Realtor's assistance and guidance). Most brokerages will institute this rule immediately if they haven't already done so. The advantage for both parties: a clear definition of services, values, duties and responsibilities, including a fee and commission agreement – and an increase in buyers' loyalty to the agent they are working with. In those cases where a buyer does not wish to sign a BBA, an agent will simply not work with and for this buyer. Questions? Please contact me anytime by phone, email or in a personal consultation. Important for you to know: this summary is based on material provided by NAR and FAR, abbreviated and edited for clarity from the perspective of a licensed Florida real estate broker with 32 years experience, however it does not offer a legal opinion or constitute any legal advice. *MLS is the Realtors’ property database, accessible only to Realtors = members of the NAR.

0 Comments

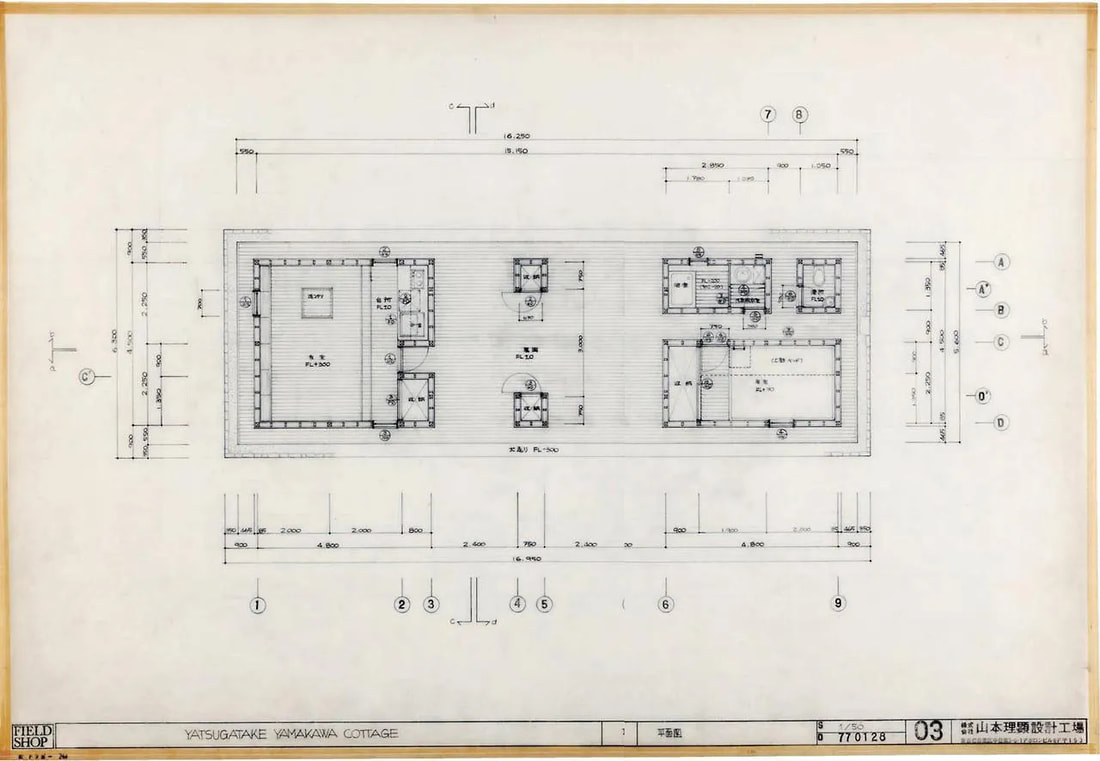

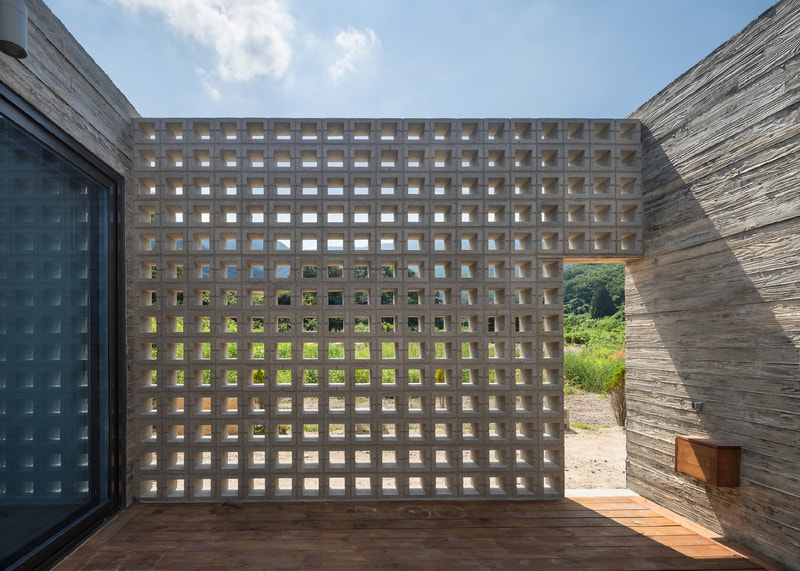

Q: Where in Florida is the house show on this page? A: It’s neither in Florida nor for sale – but since you already have a knack for modern architecture being on this website: The house is Yamamoto's first published commission, the Yamakawa villa, built 1977 in Yatsugatake, Japan. Q: Is my vision ok? A: Yes, it is. You are seeing correctly, the Yamakawa villa has no unifying exterior walls, instead each room is placed by itself on the deck. The concept stems from the client’s request to blur the boundaries between the interior and the natural world, and to integrate the house as seamlessly as possible with its surroundings. “The real value of architecture is found in the spaces it shapes, not just the structure itself.” – Riken Yamamoto. Q: So who is Mr. Yamamoto? A: He is the 53rd Pritzker Architecture Prize laureate and the ninth from Japan. Q: Why is that Pritzker so important – and why should I care? A: Established by the Pritzker family of Chicago through their Hyatt Foundation in 1979, it’s architecture’s equivalent of Sundance, Golden Globe, Cannes, Berlinale and Oscars all rolled into one. In short: it’s really important and a major honour. The idea is "to honour a living architect or architects whose built work demonstrates a combination of talent, vision and commitment”. Q: Ok. I took the bait and now I'd like to read more. A: Explore Yamamoto-san’s interesting work at Archeyes, Dezeen and Archinect. It’s worth it. Project Data

Architects: Riken Yamamoto & Field Shop Location: Yatsugatake, Nagano Prefecture, Japan Site area: 1,050 m2 Building area: 168 m2 Floor area: 68 m2 (enclosed area) Year: 1976 – 1977 ©Tobias Kaiser #pritzkeraward #architectrikenyamamoto #architecturephotography #design #homedesign #followme #miamirealestate #midcenturymodern #southfloridarealestate #modernarchitecture #modernhomes #floridahomesforsale #floridamodernhomes #remodel #renovation #floridarealtor #modernarchitecture #mcm #bauhaus #preservation #realestateconsulting #realestatetips #renovation ___ (Photos by Tomio Ohashi) Curious how the housing market in Southeast Florida is currently doing?

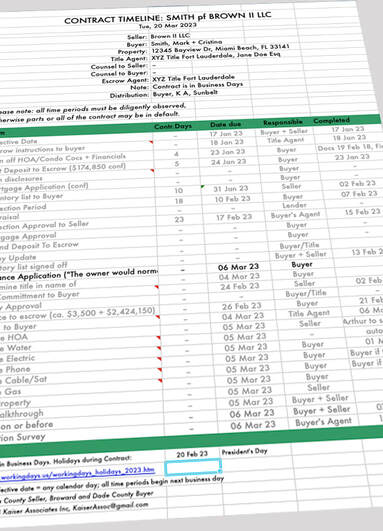

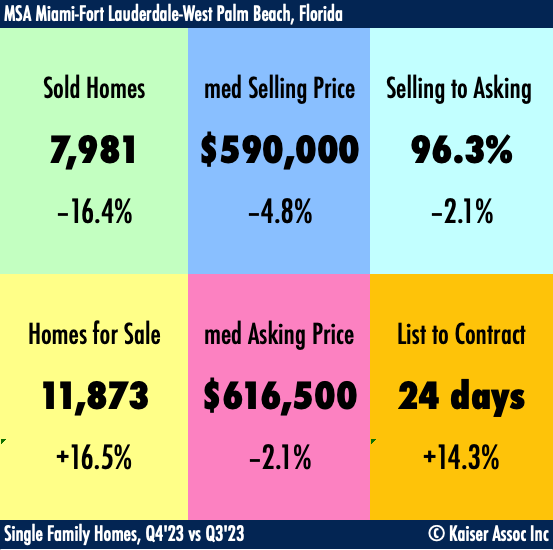

Here is an at-a-glance overview for the Single Family Home market (condos and THs excluded), comparing the 4th Quarter 2023 to the 3rd Quarter. The data covers the MSA Miami–Fort Lauderdale–West Palm Beach, Florida, aka the Tricounty area. If you are considering selling or acquiring a property and would like more detailed market information, please contact Tobias anytime. (Infographic ©Kaiser Assoc, data by BeachesMLS and FAR Sunstats) [Please note: (1) The median asking price is from those homes which actually sold, not for all homes offered for sale. (2) Any variation to prior stats results from late reports.] #housingmarket #floridarealestatemarket #floridaliving #floridamodernhomes #midcenturymodern #midcenturymodernarchitecture #preservation #floridarealestate #palmbeachrealestate #miamirealestate #bocaratonrealestate #design #floridahomesforsale #modernarchitecture #modernhomes #modernism #realestateguide #floridablogger #floridarealtor #luxuryrealtor #modernist #realestateinvestment #realestatetips  Whether you are a first-time buyer or a seasoned seller, paperwork can feel overwhelming and frustrating. However, with the right tools and tips, you can simplify the process and ensure a smoother transition. In this blog post from Modern South Florida Homes we will provide you with valuable advice on how to stay on top of the paperwork that comes with buying or selling a home and make the process less stressful. Set Reminders One of the most important things you can do to keep on top of the paperwork involved in the home-buying process is to set reminders. This means that you should keep track of all necessary deadlines, including key dates, such as mortgage approvals, home inspections, and closing dates. It’s also a good idea to work with a real estate professional who makes it habit to run a timeline of the whole process, from contract to closing, and every step along the way. Using a calendar app or setting email reminders can be beneficial in ensuring you stay on top of important deadlines. By setting these reminders, you can ensure that all the necessary paperwork is signed, sealed, and delivered on time, which will help make the entire process smoother. Document Your Timeline Buying a home involves constant communication with multiple parties. This can make it easy to lose track of everything. One of the key steps that you should take is to document the timeline and cross-check each event with any relevant deadlines to prevent delays. Create a project management sheet or a checklist or use dedicated software like Trello to keep air-tight tracking of all the important dates. Note: Tobias Kaiser automatically creates and distributes a timeline for every one of his residential and commercial transactions . This timeline and all milestones get constantly updated, from signing of the contract until after closing. Color-Code for Easier Organization If you’re looking for ways to simplify and streamline your paperwork, consider color-coding your files. Use a color code for different document types, with a corresponding colored folder for each one. This will help you to quickly and easily locate the relevant documents that you require at any given moment, making the process run smoother and quicker. Keep Hard Copies in a Dedicated Drawer While going digital has several benefits, including easier organization, there are still some physical (or "hard") copies of paperwork that you need to keep. For these, designate a specific drawer to keep them in. Ensure that these copies are always easily accessible in case you require them. This creates an easily accessible backup, especially if there are any glitches in your digital system. Digitize and Convert All Relevant Paperwork In today's fast-paced digital world, it has become essential to digitize all relevant paperwork and convert them into PDFs for easy organization and adjustments. This not only saves physical space but also enhances the efficiency of managing and accessing important documents. To streamline the process and ensure high-quality conversions, try this PDF file converter. It allows you to easily transform your files into a universally compatible format while maintaining the original layout and quality. Say goodbye to the hassle of dealing with piles of paper and embrace the convenience of digital documentation! Utilize Online Banking Another tip to help you manage your finances when buying or selling a home is to utilize online banking. This helps you manage your finances and reduce the amount of time spent on paperwork. Online banking offers several benefits, including the ability to view account balances, track transactions, pay bills, transfer funds, and even apply for loans. It eliminates the need for constant visits to the bank, and everything can be done from the comfort of your own home. Buying or selling a home can be a stressful process, but the right tools and techniques can help you stay organized, focused, and calm. Remember to set reminders, document your timeline, keep physical copies in a dedicated drawer, color-code for easy organization, digitize and convert all relevant paperwork, and utilize online banking. By following these tips, you can stay on top of your paperwork and have a smooth home buying or selling process. Good luck! Whether you’re buying or selling a Florida home, Modern South Florida can help you. Make an appointment today! It's a question Realtors hear a lot and don't mind–many folks have an interest in the local housing market since it affects the biggest investment they likely own. But they often don't have reliable local data. So they ask their friendly real estate broker or agent.

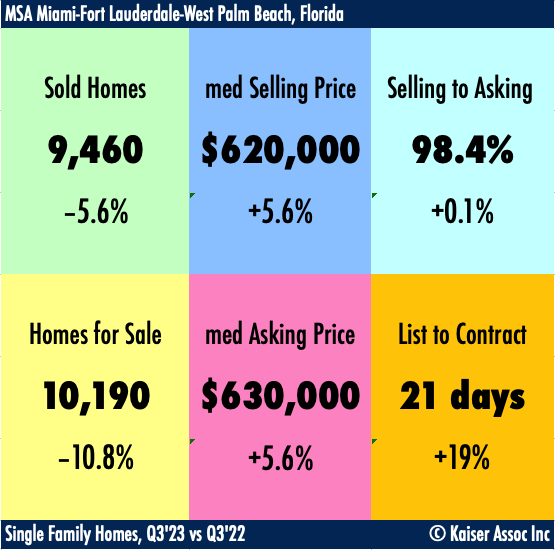

This month' snapshot gives you the key data for the Single Family Home market, Q3 '23 compared to Q3 '22, for the Miami–Fort Lauderdale–West Palm Beach, Florida, MSA (the "Tricounty area"). Fun Fact: The most expensive area sale in the 3rd quarter was a home listed for $75,000,000, reduced to $68,000,000 and finally selling for $57,000,000–a sweet 24 percent discount from the original price. Of Note: 16.3% of all US-home purchase contracts were canceled in September, as buyers are extra cautious in an increasingly unaffordable market and walk away. At the same time lenders will not accommodate fantasy prices, and sellers have to get used to making more concessions to close a deal with those buyers who can afford to buy. For much more detailed market information relevant to your plans, you are invited to contact Tobias anytime. (Copy and Infographic ©Kaiser Assoc, data by BeachesMLS and FAR Sunstats) #housingmarket #floridarealestatemarket #floridaliving #floridamodernhomes #midcenturymodern #midcenturymodernarchitecture #preservation #floridarealestate #palmbeachrealestate #miamirealestate #bocaratonrealestate #design #floridahomesforsale #modernarchitecture #modernhomes #modernism #realestateguide #floridablogger #floridarealtor #luxuryrealtor #modernist #realestateinvestment #realestatetips  A closing is the exchange of property ownership against money. It is conducted by a title company, which handles the "money against keys" process and all legal aspects, including recording of the change of ownership. The closing date is contractually agreed upon by both parties, but can be modified as long as both seller and buyer agree. Unless there is an exception, after the closing the buyer has possession of the property and can move in. Before closing, buyer and seller will receive a closing- or settlement-statement, detailing all amounts to be paid out at closing from the escrow account. Prorated real estate taxes and other fees are also shown here. Funds transfers, now mostly in form of a wire transfer into the title company's escrow account, and especially international wire transfers should be ordered in time to make sure that the funds arrive punctually, otherwise the closing will have to be postponed, much to the irritation of everyone involved. Tip: Avoid closing on a Friday – any questions which have to cleared up may cause the closing to be delayed until the following week. Complications ensue – movers are ready to unload etc. The buyer or seller does not have to be present at closing if his lawyer or agent hold a proper power of attorney. Since COVID-19, closings can also be handled long-distance, and some title companies employ officers which are certified in conducting international closings via video-conference, unheard of pre-COVID. In some cases, original documents may still have to be mailed to the buyer or seller with specific signing instructions, which have to be observed to ensure the validity of the signed documents. Not legally required but an absolute must is a walk-through the day of the closing (or the day before) by the buyer and/or his Realtor. The purpose of the walk-through: to ensure A) the property is in the condition agreed upon and B) it is vacated and cleaned as specified. If the seller did not perform as he should – and this happens more often then you think – the closing can be postponed or funds can be withheld from the seller until everything is in order. Recording the new ownership with the community or county records will be handled by the title company or buyer's lawyer. ___ The complete guide, updated frequently, is available in English and in German – get your free copy by sending an email. For this overview of modern homes on the market in South Florida between $1.5m and $2.5m, there were too many interesting ones to show them all. My ten that made the cut: 4 bedrooms/3 baths home, ≈ 3,796 sf (349 m2) under air, built 1984. A ‘project’ on 10 acres, priced to sell at land value. #3267, $2,000,000 4/4 pool home, ≈2,586 sf (238 m2), built 2020. Terrazzo floors, vaulted ceilings and top-shelf fixtures and finishes. #3455, $2,100,000 5/3 pool home, ≈6,045 sf (556 m2), built 1985. Dome-shaped over three levels, with photo darkroom and indoor lap pool with sauna. #1913, $1,850,000 3/3 pool home, ≈1,593 sf (147 m2), built 1950. In a guarded community, with separate guest house. New kitchen, impact windows & doors. #10783, $1,890,000 5/4 pool home, ≈3,420 sf (315 m2), built 1963. In walking distance to beach and an upscale marina, close to shops and restaurants. #9838, $2,250,000 3/2 waterfront pool home with dock, ≈2,060 sf (190 m2), built 1955. Fully reconstructed, offers ocean access without fixed bridges. #3070, $1,795,000 4/3 waterfront pool home, ≈3,128 sf (288 m2), built 1975. On a lagoon backing up to a park, a block to the beach. Main house & guest house, AirBnB possible. #7799, $2,499,000 4/2 pool home, ≈2,980 sf (274 m2), built 1957. Substantially upgraded. 3rd bathroom space is plumbed. Detached studio/workshop. #6714, $1,699,000 4/3 home, ≈1,492 sf (137 m2), built 1950. Fully remodeled, in walking distance to beach, restaurants and Houses of Worship. #6558, $1,650,000 6/5 pool home, ≈4,664 sf (429 m2), built 2003. Industrial Modernism on 7+ acres, gated, with pool, pond, guesthouse and tennis court. #9321, $2,000,000

For more information on any of these homes please contact me anytime! __ Properies courtesy Real Broker, Castelli, Compass (2), Miami Connections, Atlantic Properties, Douglas Elliman, BHHS EWM, Keller Williams, Coldwell Banker #housingmarket #southfloridarealestate #floridahomesforsale #floridamodernhomes #design #architecture #architecturephotography #miami #jupiter #delraybeach #fortlauderdale #midcenturymodernhome #modernarchitecture #modernism #realestateguide #architectureporn #floridarealtor #interiordesign #remodel #waterfront In a hot real estate market it is very common that a seller's pipe dream becomes reality with the help of a blind-sided buyer – out of necessity, or having fallen in love with the home, or simply not caring about being overcharged.

But the appraisal can easily turn out to be a big bucket of ice water if it arrives way below the contract price. That may happen for a variety of reasons. One of them can be a lack of comparables – specifically sales data for niche properties such as modern architecture. Appraisers are certified by the state they work in, and for a property appraisal have very specific property criteria they have to consider, including location, size, built quality, construction details, neighbourhood and recent comparable sales in the vicinity. But in my experience some appraisers did not have a lot of exposure to modern architecture, a small niche of the housing market – about two to three percent of the market for single family homes in Southeast Florida; often less in other areas with less modernist homes. Which in turn might lead to a low appraisal. This is important insofar as over the last 15 to 20 years my proprietary data show that on average modern homes sell consistently for higher prices overall and per square foot than all other single family homes. Other reasons for a low appraisal include hungry sellers or real estate agents creating a market analysis catering to a seller's aspirational pricing. If that happened knowingly, a buyer will likely encounter a purchase contract clause – mostly called "appraisal waiver" – that prohibits the buyer to cancel the contract because of a low appraisal. As a buyer you should beware this very costly trap. What can buyer and seller do if the appraisal comes in low? Bridge the Difference with Cash The buyer might be able to close the gap between appraised value and contract price with cash. Sometimes a lender objects however, so this route has to be verified. A variant of this solution is for both parties to give a little and meet at a lower price point. Price Reduction The seller agrees to a price reduction. In a hot market or for really unique properties in demand the chances for that are... well, close your eyes and what do you see? Exactly, those are the chances. But it is worth asking: a seller and his/her Realtor has to realize that the same obstacle will reappear with the next buyer. And the one after that. And... Get Comparables Both parties can ask their agent(s) to present the market analysis (often called a CMA) on which the listing price or purchase price are based, update it if needed and then submit it to the lender, asking to please consider it in a review of the appraisal amount. Verify the Appraisal A buyer automatically receives the appraisal, a seller should always ask for a copy (though this a courtesy and not a right). A review is worth the time to check for any obvious mistakes such as wrong square footage, incorrect updates or unacceptable comps. That rarely happens but neither party is obligated to accept the first appraisal. The seller can order his/her own; it's the lender's choice if that will be considered or not. A buyer can ask for a second appraisal; the stronger the reasons the better the chances the lender will order a second report. Again it's the lenders choice but: Don't ask, don't get. Cancel the Deal If nothing works, if the appraisal-escape clause is intact and if the cancellation time frame has not expired yet, the buyer can cancel the transaction. There are two possible outcomes: the seller realizes the problematic situation and, having a buyer now versus another contract with another possible buyer later, offers to negotiate a compromise. Or the seller can't/won't compromise and has to find another buyer, while the cancelling buyer has to find another property worth an offer. Tip What has proven to be extremely helpful when an appraisal comes in low is having an experienced, clear-headed agent on board (or two, if buyer and seller are working with different Realtors) who has successfully negotiated around such road blocks before. You do not want to be the seller or buyer who pays the tuition for a newbie Realtor in form of loosing a deal. Questions, comments, experiences? Do let me know please! ____ "Appraisal came in low - What to do?" by Tobias Kaiser, CC BY-NC-ND Architecture is an art form that shapes the world we live in, its impact often felt for generations. One such influential figure in the profession is Paul Revere Williams, an architect whose groundbreaking work and remarkable life has left an indelible mark on American architecture. Born in 1894 to a mixed-race family in Los Angeles, California, Williams was orphaned at the age of four but was raised by a devoted foster mother who encouraged his talent. As a high school student, he decided he wanted to pursue a career in architecture, and despite the racial barriers of the era, he defied all odds and became an architect and trailblazer in his profession: Williams was the first African American to become a certified architect west of the Mississippi, in 1923 the American Institute of Architects’ first Black member, in 1957 the first Black member to be inducted into the AIA’s College of Fellows, and in 2017, he was posthumously bestowed with the AIA's 2017 Gold Medal, the organization’s highest honor, making him the first Black recipient of this prestigious award. His portfolio more than 3,000 buildings contains many of L.A.’s important private and public structures, including parts of Los Angeles International Airport and the Beverly Hills Hotel, not to mention the residences of many wealthy clients and Hollywood A-listers, from Carey Grant, Barbara Stanwyck or Frank Sinatra to Lucille Ball and Desi Arnaz. It encompasses a wide range of architectural styles, including Mid-Century Modern, Mediterranean Revival, and Streamline Moderne. Williams was renowned for his versatility, adaptability, and ability to cater to the diverse needs of his clients, seamlessly blending modernist principles with traditional aesthetics, ensuring that each structure was a reflection of their unique personalities. But Williams' popularity extended beyond residential projects. He was involved in numerous commercial ventures, designing iconic buildings that became symbols of their respective communities. One such example is the Theme Building at the Los Angeles International Airport (LAX). Completed in 1961, this futuristic structure, with its sweeping arches and innovative design, captured the spirit of progress and innovation that Los Angeles was known for. The Theme Building became a symbol of Los Angeles and a testament to Williams' visionary approach; it is now designated as a Historical building. Photos:

1. Theme Building at LAX, Los Angeles, CA. Architects Paul Williams and Welton Becket, built 1957–1961. Exterior and interior designated as a historic-cultural monument; photo via Thomas Hawk 2. Pool at Paley house, Beverly Hills, CA, 1934; photo by Paul R. Williams Collection 3. La Concha motel (now Neon museum), Las Vegas, NV, built 1961; photo by Neon museum 4. Robert Norman Williams house, Ontario, CA; 1947; photo by Cameron Carothers 5. Crescent Wing, Beverly Hills hotel, Los Angeles, CA, 1940s. Signage is from Williams’ own handwriting; photo via Wikimedia 6. Lahr house, Beverly Hills, CA, 1941; photo unknown 7. Lucille Ball-Desi Arnaz house, Palm Springs, CA, 1954; photo by Julius Shulman? 8. Golden State Mutual Life Insurance, Los Angeles, CA, 1949; restoration by Steinberg architects; photo by Paul Turang 9. Paul Williams house, Los Angeles, CA, 1952; photo unknown 10. Living room original condition, Paul Williams house, Los Angeles, CA, 1952; photo unknown 11. Living room, Paul Williams house, Los Angeles, CA, 1952; photo by Mel Melcon/LA Times 12. Williams drawing by Charles H. Alston, via wikimedia In addition to his residential and commercial projects, Williams was involved in numerous community and civic initiatives. He championed public housing projects and designed schools, churches, and medical facilities that focused on creating inclusive spaces for all. His MCA Building, later renamed the Golden State Mutual Life Insurance Building, exemplified his commitment to social progress and the empowerment of marginalized communities. Paul Revere Williams' legacy extends far beyond his architectural achievements. He shattered racial barriers in the profession during an era when racial discrimination was still rampant in America, paving the way for future generations of diverse architects, leaving an indelible mark on the profession. His designs continue to inspire architects and shape the architectural landscape today. His ability to seamlessly blend modern and traditional elements, coupled with his focus on creating spaces that are functional and visually stunning, serves as a timeless testament to his genius. Further reading:

___ "Paul Revere Williams, AIA's first black architect" by Tobias Kaiser, CC BY-NC-ND One of highly-acclaimed restaurateur Ashley Christensen’s restaurants in Raleigh, North Carolina, is aptly named after the two unavoidable occurrences in our lives: “Death and Taxes”.

With that charming thought in mind, before buying or selling any US property please consult a recommended and experienced tax advisor, independent if you are a US citizen or a Non-resident. Among other subjects, this consultation should clarify under which name (e.g.: company, land trust, your heirs) you will take title to the property. Inheritance tax in case of the death of an owner or co-owner will be directly influenced by this and can be substantial. Additional issues that should be discussed in a consultation are taxable income from investment properties, FIRPTA, tax treaties with such countries as Austria, Germany, Luxembourg or Switzerland to avoid double taxation, and what duration of stay per year may trigger US taxation: permanent residents, green card holders and US citizens are taxed on their worldwide income regardless where they reside. In such case, expatriation, certain exception of US citizens residing in Puerto Rico and the US Virgin Islands or giving up the Green Card are likely the only options to circumvent worldwide taxation. Lastly, the State of Florida doesn’t levy a state income tax. Instead, counties and communities finance themselves mostly through real estate or property taxes. They are based on a percentage of the market value and paid annually. Every property owner – residential, commercial, industrial or land owner – has to pay them. Non-payment can result in loss of the property, so property taxes are not to be handled casually. Important to know: a change in ownership triggers a new property assessment which results a tax increase, unless the purchase price is lower then the previous purchase price. Beware of relying on the tax amount the current owner pays – a new owner will nearly always see an increase, which can often be estimated with online tax calculators for the county the property is located in. Ask your Realtor or real estate broker for further guidance. __ "Insider Guide to Florida Real Estate Transactions, ch. 10: Taxes" by Tobias Kaiser, CC BY-NC-ND Even in a region such as South Florida, relatively well-stocked with modern single family homes from the mid-century to today, the market share for this type of architecture is relatively small: under 3 percent of the overall SFH market. But it is driven by dedicated and sophisticated fans – both owners and buyers. Prices for modern homes moving mostly in tandem with the regional housing market, but experience from the last 15 or 20 years shows modern architecture fetching a premium. Covid-19 and the resulting massive influx of wealthy buyers, mostly from the Northeast US, drove up prices further. The chart below gives you an overview of listing and selling prices per sf (median per quarter). Fascinating is the spread between asking prices for all modern homes for sale (blue) and the asking prices of those modern homes that sold (orange): Note the massive gaps in the last quarter '22 and also the first quarter '23: overall "aspirational" asking prices for modern homes (blue) are barely nudging, but realistic asking prices lead to a sale (orange). Translated: many sellers are still in lala-land, while buyers put pen to paper only when the price is right. Big surprise. For your inner geek or the statistician who likes details, here is the underlying table: For any questions, even more detail or a market analysis of a specific home you consider selling or buying, based on proprietary modern home market data for Southeast Florida, do contact me anytime. __ How is the Housing Market for Modern Homes by Tobias Kaiser, CC BY-NC-ND incl. Data and Chart Have you ever fantasized of cooking in a modern and advanced kitchen in your mid-century modernist house? As you may already know, taking influence from the Bauhaus and American high-prairie style homes, mid-century modern architecture became extremely popular in United States after the Second World War, fueled by famous European architects working in the US such as Walter Gropius, Richard Neutra, Marcel Breuer and Ludwig Mies. At its peak in the 1950s and '60s, mid-century modern architecture was iconic and adored – as much as it is now again. Today, these homes are considered some of the most beautiful in the United States and much sought-after, because of their unmistakable style, simple, classic materials and equal weight given to form and function. If you're a fan of elegant and minimalist style, you'll love the results of a thoughtful period-correct remodel of a mid-century modern house. But most of the time, owners, purchasers and contractors install entirely inappropriate kitchens. Which leads to the questions: what are the best possibilities for the kitchen of a mid-century modern house? Do you know where to look? Do you have a limited amount of time to research kitchen designs? Are you afraid a modernist kitchen might be a money sinkhole? We have the answer for you. In this article, we focus on picking the correct kitchen to replace or renovate the current one in your MCM house. Kitchens have always been an important part of a home, but over time they have changed their function and consequently how they look. Becoming more technological and innovative while the time it takes to cook has gone down, they have evolved from food prep to social center. Everyone in the house gathers in the kitchen, it’s where we eat breakfast, lunch with the family, and appetisers before dinner. If space is sufficient, it can also become a place to study and work. No surprise then that our kitchen is one of the places in our house where we spend the most time with our family and friends. If you are embarking on a renovation of an MCM home, chances are high that the kitchen you choose to install won't match or will be from the wrong time period. This article is all about assisting you to make sure you don't pick the first option on the market but instead choose carefully, so that your kitchen can become the new best space in your house. You do not want an average kitchen–you really want a kitchen that matches, emphasises and enhances the design of your home. So, what are your options? Here at Modern Florida Homes, we researched and made a list of some of the best companies in America that make kitchen cabinets (appliances are a separate subject not covered here). We included our best hints for designing a modern kitchen to suit your tastes and different budgets. Depending on the design you are imagining, here are some options to update the kitchen in your mid-century modern home: If you do not want to spend a lot, start at the home improvement stores. Home Depot has some low-cost options for a modernist kitchen that will fit in with the style of a mid-century modern home. Neutral colours are best for modern kitchen solutions, like the Cambridge Base Cabinets or the Shaker Wall Cabinets. Lowe's is a good alternative for modern kitchen compositions in the same price range and has a wide selection of modernist kitchen cabinets. Starting at an affordable range of prices, MasterBrand has a wide range of cabinetry products that are made to fit any MCM or modernist home. Its main office is in Indiana, and it makes more cabinets than any other company in North America, all on different budgets. Their family of brands can accommodate any design choice, but for modernist homes, particular attention can be given to the Ultrcraft and Kemper brands for their minimalist design. For good quality at a good price range, Merillat Cabinetry is your Michigan-based choice. They can help you improve the layout of your kitchen on a budget, you can request a design consultation, and they also have an online tool that can help you budget and decide what makes sense for your kitchen. Even though Merillat only offers a few designs, the designs are elegant and simple, and all of them can be used to create a modernist kitchen space. For mid-range solutions Starmark Cabinetry offers some options for your modernist kitchen. The Bedford door style could be one of the best solutions. Paired with marble or stone surfaces, it will give your mid-century modernist home a new design. For luxury solutions and beautiful designs, with a passion for Italian design, Snaidero has multiple showrooms and gives you many ways to make your kitchen look and work the way you want. Trendy or classy, the kitchen cabinets will make your kitchen look like a monument. Porcelanosa is an alternative, with European-style cabinets that are sleek and full of new concepts. With solid surface countertops, Porcelanosa is a diverse company with a wide range of products that go well with a mid-century home renovation. In the United States, Porcelanosa has multiple showrooms and it’s possible to book an appointment with a design consultant. If your upscale taste leans towards clean and beautifully crafted German design – which Tobias as a German will applaud with a wink – you’ll be delighted by the German Kitchen Center. They have 17 showrooms throughout the US, two of those in Tampa and Miami. In addition to a wide variety of European kitchens – not only German but also Italian etc. – they offer free catalogues, a free 3D kitchen design program to download and free kitchen design consultations. As an additional guide, the website Chef's Pencil has a ranking of ten German kitchen manufacturers present in the US; oddly enough Miele is not mentioned. That said, would you rather go the way of least resistance and let your General Contractor install something, or would you install a modernist kitchen in a mid-century modern residence? Kitchens in modernist homes are designed with an eye on function and form. To achieve crisp aesthetics and effective ergonomics, flat surfaces and geometric forms are emphasized in modernist kitchen designs. It is possible to add a modernist kitchen to a modernist home without compromising the décor, and ideally will yield a unified seamless result, a harmonious ensemble integrating your kitchen with the whole of the home without a break in style. In addition, modern design is based on the most recent developments in the kitchen design industry. Rather than a cohesive movement with a specific style, design changes with trends, taking inspiration from a wide variety of styles from different times. You really can pick a modernist kitchen that matches the color palette and style of your home. Modernist kitchens can make your home a better place to live, raise the value of your property, and make your daily life more fun. Plus, your friends and family will be amazed. You’ll never get them to leave. -- Do you have any experience installing a period-correct kitchen? Or questions about it? Do let me know please! "Why does your Modernist Home need a Modernist Kitchen? (It does)" and photos by Tobias Kaiser, CC BY-NC-ND  If you consider buying US real estate as a non-US citizen, this short primer offers you a brief overview – without giving legal advice and without replacing the need for an experienced US immigration attorney and a tax advisor. Owning US real estate: Overall, foreign citizens can acquire, enjoy and visit their residential or commercial US-properties without many restrictions or difficulty. But the purchase of a vacation property – such as a single family home or condominium, as owned flats are called here – does not qualify for a long-term visa or permanent residency, independent of the purchase price. Visits to your property are typically limited to three months, with possible extensions. Many countries have an agreement with the US for Visa-free visits. Caveat: To avoid being taxed by the US Internal Revenue Service (IRS), total time per year in the US should be limited to approx. 180 days (keyword "substantial presence test"; please consult a US tax advisor). Different is the situation with the purchase of investment real estate. When specific criteria are observed, a long-term visa or permanent residency with work permit can be reasonably expected. Especially interesting are the EB-5 and the E-2 options. EB-5 Immigrant Investor Program: This visa is one of the most straightforward ways for a foreign investor to obtain permanent residency in the US. Its goal is to create or save American jobs. A foreign national, through a direct investment under specific criteria or into a USCIS-approved "EB-5 Regional Center" which is an investment project, can obtain Permanent Residency for him/herself and eligible family members. Conditional residency is granted for two years, after that permanent residency ("Green Card") and later US citizenship can be applied for. In case of a direct investment, the investor has to be actively involved in the business. For Florida as of March 2023, the minimum investment amount is $1,050,000. E-2 Treaty Investor Visa: There are many benefits to this visa. Valid typically between two and five years, it can be renewed indefinitely as long as the underlying original investment (business) continues to exist and operate. A possible drawback is that – with exceptions – an E-2 does not offer a path to permanent residency. However, there is no official limit on the number of renewals, and there is no cap on the annual number of E-2 visas. Furthermore, there is no defined minimum investment amount, instead a “substantial investment” (approx. $100,000 equity have qualified applicants in the past) in an “active ongoing business” which must be “at risk” (no raw land, for example) is required. The investor has to be actively involved in the day-to-day operation, which must be more than just marginally profitable. Approval of an E-2 is determined on a case-by-case basis by the viability of the business invested in. Obtaining US Citizenship: Besides several other criteria, an applicant for US-citizenship must have been physically present in the United States for at least 30 months out of the five years immediately preceding the date of filing the application. Example: if you have a Green Card but lived in Switzerland for four of the last five years, you will not qualify. If you are a non-US resident considering buying US real estate, please discuss your plans with your broker and, since US-licensed real estate brokers and agents are neither qualified nor allowed to give legal advice, it is absolutely vital to consult a recommended immigration specialist prior to any purchase or even contract offer. Note: Immigration and visa policies may change at a moment’s notice. Your immigration attorney will have an overview on the most current status of the law. Comments? Questions? Please contact me anytime; I'd be delighted to assist you. The complete Guide to Florida Real Estate Transactions is available in English or in German – send a quick email to request your copy. Next chapter in this series: Taxes ____ "Insider Guide to Florida Real Estate Transactions, ch. 9: Property Ownership, Visits and Visas for Foreigners" by Tobias Kaiser, CC BY-NC-ND Celebrating International Woman's Day – honoring Marion Manley, Miami's first Female Architect9/3/2023 The second female architect in Florida, and the first in Miami, was Marion Manley (1893-1984) who registered as an architect in 1918. Likely influenced by her studies at University of Illinois under Rexford Newcomb, Dean of Fine and Applied Arts, the style of her early residential commissions was heavily Mediterranean. WW I forced a pause; upon returning to Miami shortly after WW I, Manley began to design large-scale Mediterranean houses with prominent Miami architect Gordon E. Mayer. After a brief stint in South Carolina, she set up her own practice back in Florida in 1924. However, in the post-war atmosphere of male dominance in the field of architecture, major success came later, in the 1940s, when she was hired by UM president Robert Bow Ashe to design a new masterplan for the University of Miami campus. Her practice was relocated onto the UM campus, and she invited her colleague Robert Law Weed to collaborate in the campus project. Weed, exaggerating his role, later incorrectly claimed most if not all of the credit for himself, while in reality Manley was the leading force behind the design of the Campus. Exposure to the writings of Walter Gropius and Le Corbusier at that time, as well as her enrollment in a summer city planning course at MIT in 1942, had the most impact on her ideals as an architect and regional planner, as evidenced in her design language, both residential and for the UM campus, which is counted among Manley’s greatest achievements. Her residential work sadly is not very well documented, and photos, especially of her modernist designs from the 1940s onwards, are practically impossible to find. The few shots of Manley's residences I could find for this post all come from the local Realtor-database MLS. The change in Manley's design language, illustrated through some of her commissions: #1: residence in Miami, built 1921 #2: residence in Miami Beach, built 1924 #3: residence in Miami Shores, built 1938 #4: Coral Gables, built 1946 #5: School of Architecture building, University of Miami, built 1947, refitted 1985 #6: Memorial Classroom Building, U.M., built 1948 #7: residence in Miami, built 1955, torn down ca. 2008 (sorry for the pathetic size) #8: Albert Pick Music Library, U.M., built 1957 #9: residence in Palmetto Bay, built 1967 Recommended reading: Catherine Lynn and Carie Penabad: "Marion Manley: Miami’s First Woman Architect"

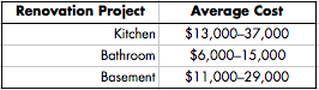

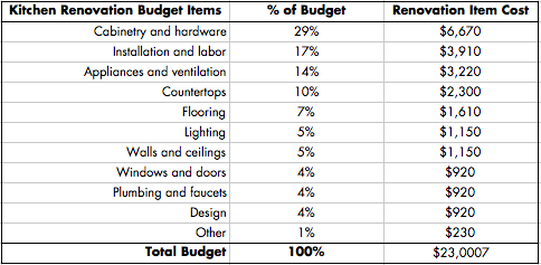

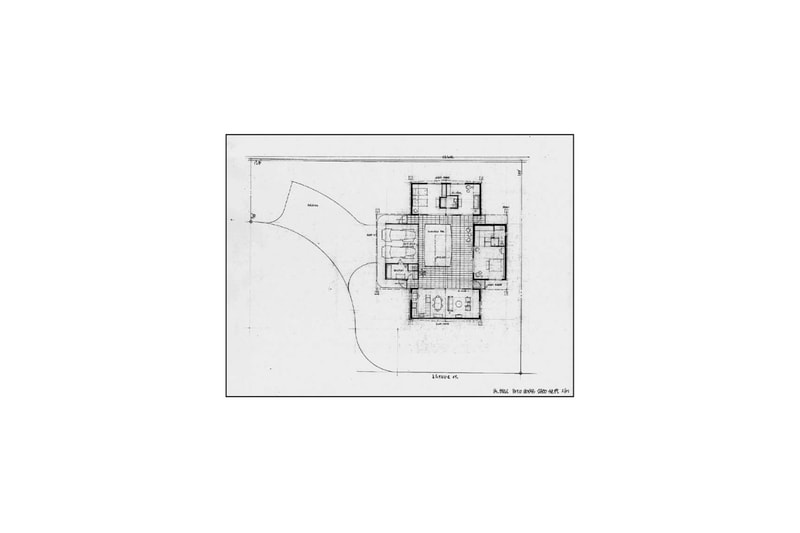

Video on Marion Manley: https://www.youtube.com/watch?v=5BSjBLa1ElY ___ "Celebrating International Woman's Day – honoring Marion Manley, Miami's first Female Architect" by Tobias Kaiser, CC BY-NC-ND. Photos: BeachesMLS, #5, #6 University of Miami, #8 Ruth Hara Home remodeling and renovation is a subject dear and near to home owners–even more so when the housing market is hot and dollar signs are luring potential sellers. But home owners are often uncertain which part of the house needs love the most. This is especially true for modern homes, whenever they were built: in the 50s, 60s or 70s, or just 15 years ago. Period-correct improvements to modern homes are not necessarily expensive, but: a generic Home Depot kitchen is less effort then contacting a consultant like me first or digging on the web for a new kitchen which matches your Parker-, Tschumi- or Duckham-design. Unfortunately, the results always and inevitably show which path the owner took. The other big obstacle for nearly every home owner is budgeting a renovation. Below, the finance advisory site Ramsey Solutions explains very well how to plan a budget for any home improvement project. You’re excited for your home renovation project—maybe you’re planning something small, like installing a new kitchen floor. But wait—the new floor will clash with the cabinets, so you decide to update those too. And while you’re at it, you might as well add a gorgeous kitchen island. Before you know it, your $2,000 dream renovation project spiked up to $20,000—yikes! To take control of your home renovation budget, you need a plan. If you want to complete a beautiful renovation without going bankrupt, this article will show you how to create a smart budget and make smart decisions that add real value to your home. How Much Does It Cost to Renovate a House? Depending on the type of room you renovate, where you live, and whether or not you’re confident with a hammer, your renovation project could cost around $10–60 per square foot, with some projects costing up to $150/sf. But what does that add up to exactly? Example: If you live in a cozy 1,000 sf home, renovations will probably cost $10,000–60,000, while renovations on a 2,000 sf home could cost $20,000–120,000. Good thing you’re planning ahead. Keep in mind, many factors make up the cost of a home renovation—including room size, type of work needed, cost of materials and how big the project is. For instance, if you’re hoping to convert your basement into a bowling alley with bar or put a jacuzzi on your roof, the cost of your project might be drastically different than the average. Here’s an example of how much it costs to renovate by project type: So if you want to renovate your kitchen, bathroom and basement, it could cost $30,000–81,000. But if your bathroom takes priority, zero in on that project and put the others on hold. The smartest way to create a home renovation budget is to lay out all the renovation projects you want done and price them. Get bids for each individual project, then rank them according to priority and start a detailed budget for the project you want done first. How Much Should I Spend on a Renovation? As a rule of thumb, don’t go crazy spending half the price of your home to renovate a room or two—that probably won’t add a balanced value to the house. The smartest way to decide how much to spend on a home renovation is to look at your current monthly budget and go from there. Let’s say your household income is $80,000/yr. and you live in a $250,000 home. Ideally, you‘d like to make $60,000 worth of renovations to revamp a few rooms, evict the squirrels from your attic, and repair the racoon damage to your roof. If you can save $2,500 a month for renovations, you can tackle half of them within the first year of saving! You also should ask yourself how long you plan to live in the house you're in: are renovating for your own benefit or do you want to sell within a year or so and increase marketability? This will determine the scope and priority of your renovation project list. How Do You Pay for a Home Remodel? If you want to be smart about paying for your renovation project, cash is the only way to go. Sure, you’ve probably heard of fancy financing options that get you into debt—like a home equity loan or a home equity line of credit (HELOC). But debt is dumb! Renovations aren’t worth borrowing what you already own of your home (which is called equity) to pay it back—plus interest! (An annual report Tobias subscribes to not only shows the average cost of 22 home improvement projects in different regions of the US––it also shows how much can be recouped when selling. Which by the way is never 100% or more! Ask Tobias for details if you are considering any remodeling project, especially if the style of your home is modern.) If you currently have consumer debt, you’re better off focusing on paying off your debt first and saving up an emergency fund of 3–6 months of expenses before tackling renovations. Then, you can take the amount you were paying into your emergency fund and use it to save for renovation projects. You’ll save yourself so many headaches by paying in cash—not to mention, your home renovations will feel like a blessing instead of a curse. A budgeting app like Ramsey Solutions' EveryDollar can help you control your monthly spending and save cash for renovations faster. Home Renovation Budget in 3 Steps To get your project moving, use these smart steps to create your home renovation budget: 1. Prioritize Projects Obviously, if a room in your home is out of whack and causing trouble, you’ll want to budget for that project first. Or if you have a strong desire to renovate a particular space, go for that one first. But if things are otherwise even, consider starting with popular home renovations that add the most value to your home and bring the most satisfaction to homeowners. Home value: If your primary purpose is to increase home value, prioritize projects that will earn you more money at your home sale than you spent on them. For example, projects like new roofing and new wood flooring earned renovators 6–7% more at resale than they spent on the projects. New roofing also ranked the highest of 20 renovation projects for helping to close a sale. Enjoyment: If you care more about enjoying the results of your renovation project, whether or not it earns back the full amount you spend on it when you sell your home, you could choose projects like a kitchen or closet renovation, which both scored the highest of 20 projects for homeowners who were happy with their renovations. (Contact me to learn for free about the cost-versus-value equation of the project you might consider.) 2. Outline Cost Estimates Now that you’ve decided which renovation to do first, break down the cost of everything that goes into that project—including all the labor and materials needed. This will take some research, so grab a cup of coffee and get cozy. Keep in mind, you won’t be able to get an exact cost until you talk with actual contractors (see #3). But digging around online will give you ballpark figures so you can be realistic about what you can get done with your budget. If you’re doing a kitchen renovation, your budget breakdown might look something like this: This will give you a better idea of how much money goes where for your renovation project. It can also show you how to cut back costs in some areas to splurge in others. For example, you could skip the new flooring and use that money to get fancy marble countertops instead. 3. Collect Contractor Bids Now you’re ready to talk to a contractor. Ask around or search online for at least three legit contractors in your area. Request project bids and timelines from each one and compare pricing. Be careful not to only be tempted to go with the lowest bid—you might end up paying for a shady character who takes several lunch breaks a day and leaves you with a half-finished project. But if the contractor checks out and the bid fits your price range, go for it. How Do I Cut Renovation Costs? One of the best ways to lower your renovation costs is to tackle home projects yourself—DIY. In 2021, more than a third of homeowners actually did their entire renovation projects by themselves! If you’re not comfortable handling every part on your own, you could still knock off some costs by doing one or two of these tasks yourself: DIY Demolition. You could cut the first part of labor costs by ripping out old flooring, tearing down drywall or removing cabinetry—and you might even have a blast doing it! Shop for low-cost materials. In 2021, 14% of homeowners purchased materials on their own and then hired out the labor. If you really want to save money, this gives you more control over how much you pay for materials. But talk this over with your contractor first, so you can make sure the materials fit your plan. Hire your own subcontractors. If your job requires multiple types of contractors, your contractor might recommend subcontractors who aren’t your best option price-wise. But if you handle finding subcontractors yourself, you can hunt for the best deal. Then again, some contractors have a set team they work with, so check with your contractor first. DIY paint job. It can cost anywhere between $200–800 to hire someone to paint a typical 120 sf room—but DIY costs $100–300!10 So you could save half the cost by picking up a brush to paint the room yourself! Sell Your Home With an Agent Who Knows What to Renovate If you’re renovating with the intent to sell your home in the next 12 months, get advice from a top-notch real estate agent in your area. (This is especially true when renovating a modern home, where there's no room for cheap & wrong remodels). An expert agent will help you decide which renovations are worth top dollar, and they’ll negotiate the best deal for you when it’s time to put your home on the market. __ If you have any questions about a home remodel project, or if you're uncertain if you should renovate or move, contact Tobias Kaiser of Modern Florida Homes for a free consultation. "Move or Remodel: How to create a Home Renovation Budget" by Ramsey Solutions, edited and updated by Tobias Kaiser, CC BY-NC-ND "The urge to remodel is stronger than the sex drive" – Gene Leedy (1928–2018), American architect, describing 'improvements' made to his mid-century modern houses. • Up to what point is a substantially altered house still modern(ist)? • Can the modifications be reversed? • If so, with how much effort and cost? These questions often arise when deciding if I should accept a property into my database of regional modernist houses. Point in case: the Brill house in Hollywood, Florida, designed in 1959 by Chuck Reed FAIA (1926-2022), who worked mostly in and around Hollywood. Reed's houses in their original form are strictly modern, relatively compact and never flashy. The Brill house, which I last visited 2013, has been modified heavily, moving it away from its intended design. That includes its main feature, a semi-open pool – Chuck explained once how he loved the rain dripping into the pool through the net-covered skylight, which is now closed off: #1: The pool. Note: closed-off ceiling openings and French doors with grilles (the glass divider thingies)

#2: Site/floor-plan. Note the compact arrangement of four functions around the pool #3: The SW elevation, on the left the now-enclosed carport #4: The former carport #5: The dining area and kitchen. Note the choice of cabinetry as well as the mosaic tile #6: Master bedroom, cabinets on left are original. Like a lot MCM homes, the lack of an attic necessitates split-unit air conditioners #8: One the bathrooms. Note the style of tiles and the added w/d cabinet. #9: View from the pool into the kitchen. Note different floors between pool deck and inside area #10: Pool photo, ca. 1959 Your thoughts? #modernarchitecture #modernism #midcenturymodern #chuckreed #midcenturymodernhome #modernhomes #preservation #architecturelovers #realestatebroker #homeimprovement #floridamodernhomesforsale #floridahomesforsale #floridarealestate #hollywood #architect #design "When is an altered Modern Home still Modern?" by Tobias Kaiser, CC BY-NC-ND - photos by BeachesMLS As home prices in Southeast Florida soften, let's have a look at a few typical offers in one of the most important price segments of the local market for modern homes: In Boca Raton, a 3 bedroom / 2 bath home with approx. 2132 sf under air, built 1985. Sited on a secluded lot, the home offers an open split floor plan with ceiling-to-floor windows and glass doors, vaulted ceilings, eat-in kitchen with kitchen bar, recessed lights and a dramatic 2nd story wrap around balcony with views from living room, dining room & kitchen. Several major systems have been replaced. In bicycle proximity to the beach. Asking $599,000 In Fort Lauderdale, a 4/3 with approx. 2067 sf, built 1953. This is currently an income-producing property, listed on Airbnb with all licenses and permits. Plenty of natural lighting around the house which features a top-of-the-line quality kitchen with island, a marble fireplace, Italian porcelain floor, as well as a new roof, new impact windows, and a new sprinkler system. It also has a 2 car garage and a big backyard with BBQ. Located 3 miles from the beach and Las Olas Blvd. Asking $775,000 In Delray Beach, a 4/4 with approx. 2199 sf, built 2020. This is a pre-construction offer, with the buyer still having the option to choose the finishes. 10 ft ceilings throughout as well as large porcelain tiles. The master offers his and hers walk-in closet, an oversized shower and double sinks. Laundry room has a wash basin. 2 car garage with long driveway. Nice covered patio and room for pool. Property is not a zero lot. 6 ft white fence all around house. Room to park your jet ski, boat, or any toys you have. Huge open side to canal. Asking $600,000 In Wilton Manors, a 4/3 with approx. 2204 sf, built 1957. Renovated waterfront home, designed for multigenerational living or vacation rentals (approved for AirBnB). New custom kitchen, energy-efficient hurricane impact windows and doors. Master bathroom with free-standing soaking tub, oversized shower, separate toilet closet and dual sinks. Eco-conscious xeriscape succulent landscaping design. Asking $839,000 In Plantation, a 3/3 with pool, approx. 1897 sf, built 1980. Open concept with soaring ceilings and high windows, very private. Two bedrooms downstairs, full bedroom suite upstairs. Den can be easily converted to 4th bedroom. Well maintained and move-in ready. In walking distance to shopping and restaurants. Asking $625,000 In Fort Lauderdale, a 4/2 with approx. 1400 sf, built 1954. Waterfront home offering ocean access with no fixed bridges (deepwater). Dock for up to 60 feet yacht. New roof, new A/C, updated kitchen and bath, new city water and sewer lines. Asking $879,000 In Miami, a 3/2 with pool, approx. 2827 sf, built 1983. Pool home with entrance atrium in a guard-gated community. It features sliding glass doors in every major room, 3 fireplaces, accordion shutters, 2 car garage, large upstairs master suite with two walk-in closets, separate bathing area w/luxurious roman tub & glass-enclosed shower. Close to supermarket, restaurants, Indian Hammock Park and Turnpike. Asking $899,000 In Fort Pierce, a 3/2 with pool, approx. 1777 sf, built 1958. Upgraded Beach Bungalow with bright open floorplan and heated Pool. Home was remodeled in 2016 including impact windows, roof, A/C, upgraded kitchen & bath, flooring, paint, & new pool. Close to Downtown and South Beach Jetty. Asking $644,500 In Miami Beach, a 4/4 bath home with pool, approx. 3263 sf under air, built 2021.

Co-ownership opportunity for one-eight of a professionally managed, turnkey home, fully furnished and professionally decorated. Open-plan main floor includes dining space and a gourmet kitchen incl. glass-enclosed 80-bottle wine rack. Spacious primary bedroom upstairs has access to upper patio overlooking pool & spa, as well as a covered outdoor kitchen and lounge. Asking $867,000 for 1/8th share. Please contact Tobias with if you are interested in any of these homes or if you are looking for a modern house in South Florida. __ Listings courtesy of cooperating MLS Realtors on BeachesMLS #architecture #design #floridahomesforsale #floridarealestate #mcm #midcenturymodern #modernarchitecture #modernhomes #brokertobiaskaiser #realestateconsultant #homesforsale #modernism #miami #delraybeach #fortlauderdale #bocaraton "What you get for... $600,000 - $900,000" by Tobias Kaiser, CC BY-NC-ND In chapter 8 of my “Guide to Florida Real Estate Transactions” I explain what occurs after signing of the purchase contract and before closing – an extremely important phase for any buyer, be it a residential, commercial or business deal: Between signing of the purchase contract and the closing – 20 to 90 days approx., depending on the type of property and if financing is involved – several activities run parallel in time: property inspection, title inspection, possibly a loan application, and, in case of a commercial or business transaction, the so-called due diligence period, which includes a review of all books and records. Latest by now please consult a tax advisor to structure property ownership under tax perspectives as favorable to you as possible. Your real estate agent coordinates all these activities for you and should be able to recommend experienced professionals for all tasks at hand. Building inspection: Within a certain timeframe the buyer has the opportunity to have the property – resale or new – inspected for functional and structural deficiencies. This inspection should never be conducted by a cousin of a friend who owns a flashlight and a voltmeter, but by a certified, licensed and recommended professional, ideally belonging to ASHI (American of Society of Home Inspectors). If flaws are found, depending on the contract the buyer can demand repairs, withdraw from the contract, or try to re-negotiate. Your agent should recommend a reliable building inspector and make the inspection part of the transaction timetable. Due Diligence: This term is used in commercial and business transactions. It refers to the defined time period for a property inspection as well as the review all books, records, profit & loss statements etc. if applicable. Again, the buyer has to accept or reject the transaction based on his/her findings before the Due Diligence period runs out, otherwise he/she has to fulfill the contract and buy. Title search: Florida has no mandatory book of real estate records; instead, property rights and obligations are recorded in the title. The buyer's attorney will research the property title history to ensure that it has clear and marketable title and is free of any unpaid debts, mortgages, liens or other surprises. A title insurance policy paid by the buyer will guarantee this for the duration of the buyer's ownership. The attorney will also check any possible usage restrictions of the property, such as commercial use, permitted vehicles, having pets or rentability. It is the buyer's obligation to check for restrictions that prevent any planned use of the property, for example as an AirBnB. Taking title: Any buyer should carefully decide how he/she will own the property - as an individual, in the name of a company, in a living trust etc. This may have a direct influence on the buyer's tax obligations – especially estate tax – and/or how the estate is passed on to the heirs when he/she dies. Seller’s obligations: It is the seller’s duty to hand the property over to the buyer at closing in the same state and condition as it was at the signing of the contract. Maintenance and repairs have to be continued by the seller up to the day of closing. To verify this, the buyer has the right to a final walk-through immediately before closing to confirm that the seller lived up to his/her obligations. If not, the closing may have to be delayed or funds to be withheld from the seller, due to incomplete repairs, damages or even junk and unwanted items left on the property, the latter being a common occurrence. For any questions you may have, and for the complete and updated GUIDE TO BUYING AND SELLING FLORIDA REAL ESTATE please contact Tobias anytime. He will be happy to assist you. ___ Next chapter in this series: Property Ownership and Visas for Non-Citizens "Insider Guide to Real Estate Transactions in Florida, ch. 8: Inspections" by Tobias Kaiser, CC BY-NC-ND Two newer homes. Both are Modern (as in: recently built; Ye Ole Castle in 2021) but only one is Modernist. Many years ago when I was to start my blog “The Modernist Angle”, we discussed the two terms "Modern"and "Modernist" in my office at length: which is which, and why is that so? In researching the terminology, I came upon an interesting forum where architects and professionals differentiated between the two terms carefully, "modernist" referring to a style or aesthetic, "modern" to something current: “Takeaway lesson: There's an important difference between 'modern' and 'modernist'. Modern means nothing more than 'current' or 'recent'. Modernist means ... the ideology of modernism, ... an aesthetic movement”. (–Ray Sawhill, on the Visual Resources Association Forum) Adding to the point: “Modernist is ultimately a more valuable and specific term for us than the more generic Modern. Modernist is our stylistic term of choice, whereas Modern seems more like a state of mind.” (–Dane A. Johnson, Visual Resource Coordinator, College of Architecture and Design, Lawrence Technological University, Southfield, MI, on the Visual Resources Association Forum). Thus, a mid-century design by Neutra, Breuer or Mies for example should really be referred to as Mid-Century Modernist. Though nobody does that, as a client reminded me when he snubbed all homes older than five years, disregarding their modernist styles. In colloquial use the term Modern is the clear preference. So my firm’s residential part is named “Modern Florida Homes”, and its mission is “Brokering, Promoting and Preserving Modern Homes and Architecture”. But in any context where one can discuss, explain and elaborate, I prefer Modernist as the correct and more precise term. A fun question to ask your favourite architect, isn’t it? You do have one, don't you? ___ “Modern or Modernist?" by Tobias Kaiser, CC BY-NC-ND - Photos: Beaches-MLS You may have seen my recent Instagram post on Conversation Pits, a modernist design element now completely out of fashion. Pity.

Much in fashion however is the Brise-Soleil – French for "breaking sun" and pronounced [breeze solay] – which in its original meaning is a wall with geometric cutouts or shading elements, preventing direct sunlight hitting a building while allowing ventilation. It might be a separating wall in a garden, or a curtain wall of a building, or even a system of louvers. More recently, the term has also been adopted for any kind of shading structure allowing ventilation, be it vertical or horizontal – though for the latter, I'd disagree with calling it a brise-soleil. Other typical design elements you'll find in modernist architecture I explain here.  I want to share two useful tips I learned from my own experience: about maintaining water quality of an indoor fountain and about pest control. Related to modern architecture: not completely, more like "somewhat". Interesting and useful: Yes. – Still with me? Please read on. Pest Control It doesn't matter if you live in Florida or anywhere else in the sunbelt, or even in areas with winter freezes – household pests, the polite way to describe yucky crawly things like Palmetto bugs, German cockroaches or a whole army of sugar ants, are a fact of life. They were here long before us. And I believe they will be here when the human race has left the planet. But: I don't live in their space, and I don't want them to live in mine. As a former commercial landlord, former property manager and 30+ year-Florida resident, I know monthly pest control is a necessity, so much it's in the Florida Landlord and Tenant statutes. But the services I tried were not very impressive. Except for my newest discovery: Ortho Home Defense. After successfully using up a 24oz/700 cc bottle "Ortho Home Defense Max Insect Killer Spray for Indoor and Home Perimeter" – can that name get any longer? – I reached for the Big Momma: a nice round 5 litres (1.3 gal) container of Home Defense, with electric (!) spray wand. Yeehaw! Through business travel and forgetfulness I found out the stuff still kills even after three or more months, and even through repeated floor mopping and cleaning. My rating: Highly recommended! (Available at the usual suspects such as Lowe's, Home Depot, Amazon etc. On Amazon, I recently saw the 1.3 gal with wand for nearly the same price as a 24 oz spray bottle, under $17) Indoor Water Fountains Not only do they provide the soothing sound of flowing water, they also play a role in improving your home's Feng Shui: The presence of moving water fills the requirements of the Shui or water component. My own little water feature was in my office for 10+ years, until the fountain finally completely crumbled and disintegrated. I kept the pump until I created a minimalist modern fountain from a straight-walled clear glass bowl and pebbles I picked from the Starnberger See, the lake near Munich where I'm from.

Maintain water quality was a bit of a drag, mostly due to algae multiplying like little bunny rabbits overnight, until I found the by far best solution: purified water with salt. No vinegar, no distilled water, no chlorine or any other additive are as simple or effective. Even after a three months travel pause during Covid, where I had turned the pump off and covered the vessel with clear food wrap: no slime, no algae, nothing. The simple solution: I fill an old soda bottle (0.75 cc) with purified water from my fridge's filtration system, mix a small pinch of salt with it, store the bottle in the fridge and use that solution to keep the fountain at the right level. I still replace the water every three months or so, and YMMV, but I couldn't be happier with the overall water quality. ___ Thank you for reading this post. Any feedback on my two tips? Financing a property purchase – primary residences, second homes, and investment properties – in the US is common: it reduces the equity requirement for the transaction and mortgage interest is tax-deductible. Since the US-mortgage crisis 2006-08, the loan process has become a bit more regulated and lengthy. Note: Financing a business purchase can be challenging for US citizens, and is extremely difficult if not impossible for foreign nationals. For residential deals, typical Loan-to-Value Ratios (LTV) are 70% – 95% for US-citizens and 50% – 75% for foreign nationals (non-US-applicants), depending on credit history, documentation and income. 100% financing is mostly unheard of in the US.

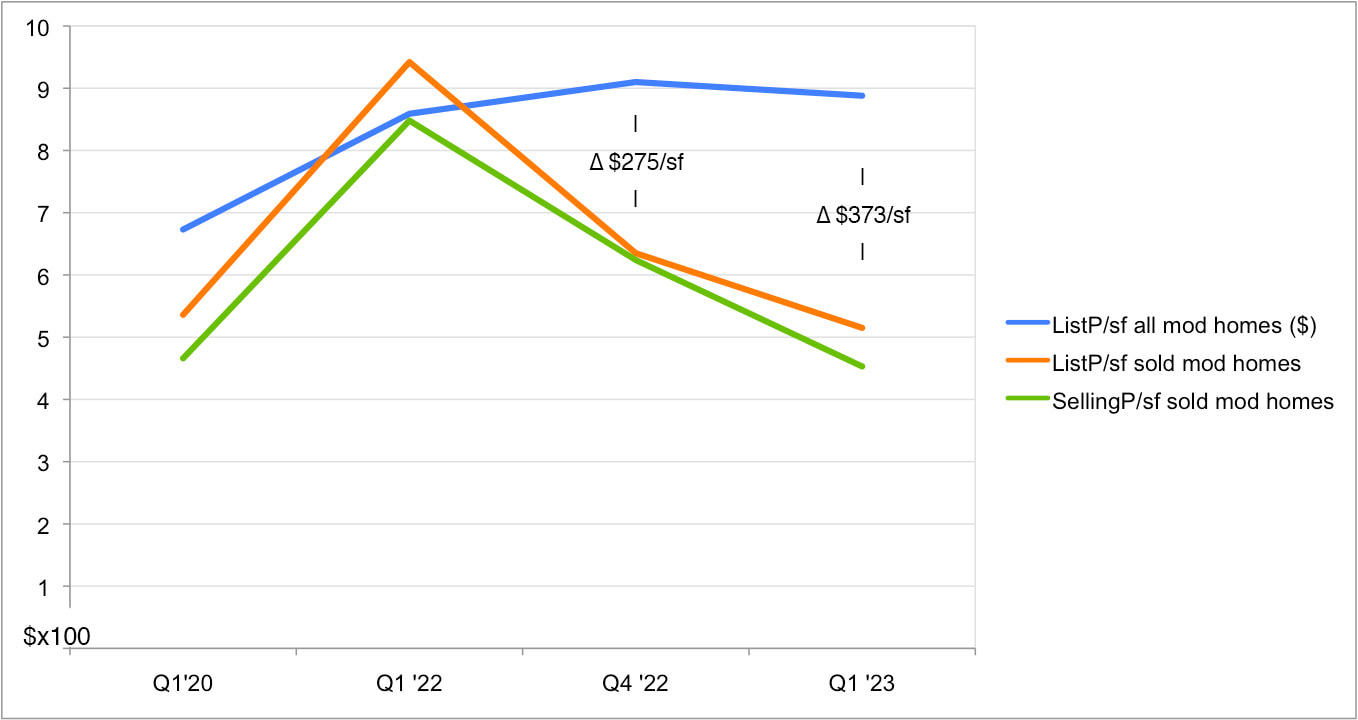

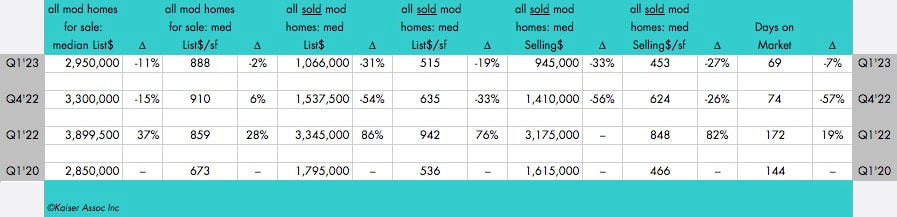

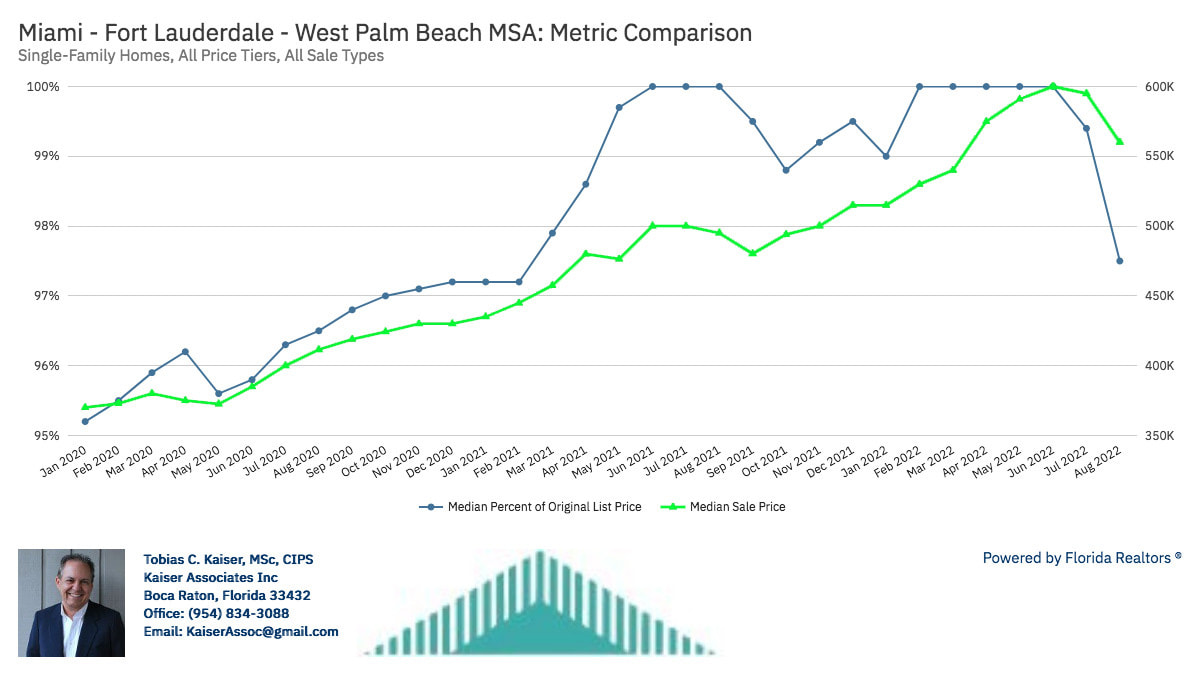

To qualify for a mortgage, some lenders require that the borrower opens an account with the bank as an additional security or pledges liquid assets (cash-equivalents, commonly traded stocks). Loan amounts can go as high as $25m for foreign nationals, and considerably higher for US citizens. Loan rates for foreigners are always higher than for US citizens or permanent residents. It pays to comparison-shop – not only because rates vary, but also as some mortgage brokers specialized in foreign nationals extract a substantial rate surcharge for the privilege of doing business, especially if they are located in the borrowers' country of origin and speak their language. If you happen to be a non-US citizen, make sure your lender is experienced in dealing with foreign nationals, or ask your agent to recommend one. For both US- and non-US-citizens, prudent lender selection will streamline the process considerably. Time frame: as of late 2022, typical loan approvals for US borrowers take at least three, more likely four to seven weeks, often longer for foreign nationals. For those, a FICO score is mostly not required, and often neither an ITIN, social security number, green card or visa. Like loan rates, the exact requirements to get a mortgage vary from lender to lender, but for both US- and non-US applicants, thorough and detailed documentation wins the day. The chart above for single family homes, from Miami to West Palm Beach, from January 2020 to August 2022, shows it.

Green are Median Selling Prices in USD, blue shows the gap between Asking and Selling Prices in %. Both lines are pointing south for both July and August. With rising interest rates, the slower home-buying season beginning and more properties coming to market, this trend will likely continue for a while. For more detailed market data incl. for modern architecture or with your questions contact me anytime please. Finally our local housing market is becoming less insane. Far from normal, but less insane is progress. And the June numbers, available one month from today, will confirm that.

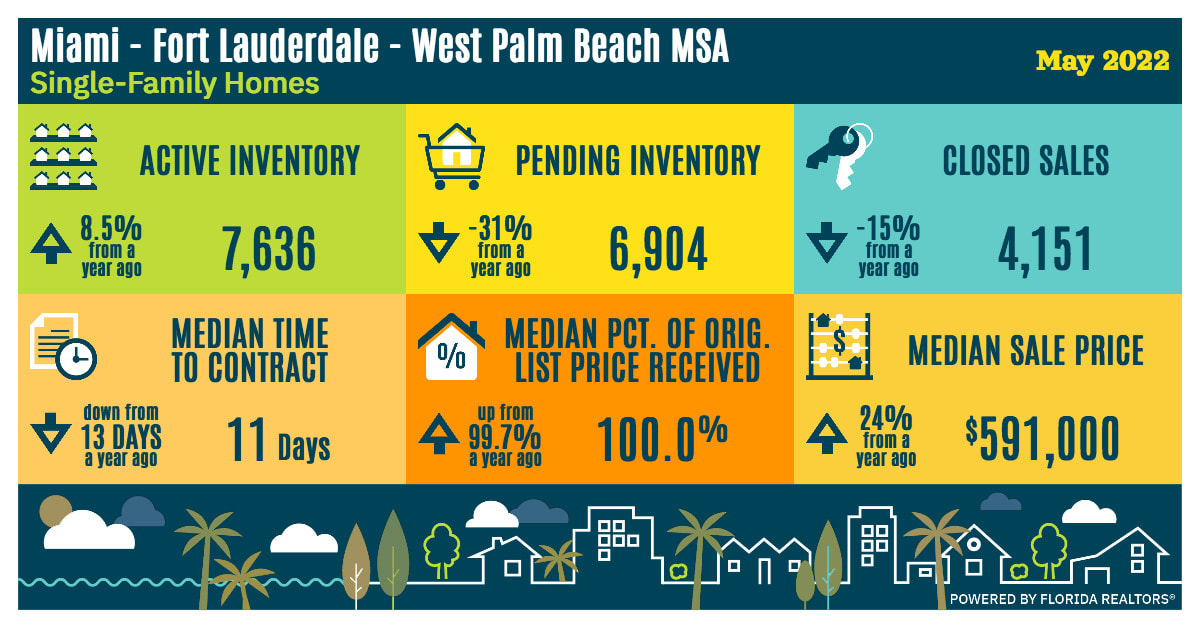

Here's a primer on how to read and interpret what is shown in the infographic above (all data for single family homes): ACTIVE INVENTORY: means number of single family homes for sale. In the Tri-County area (in essence the MSA or Metropolitan Statistical Area described above), this number should be north of 14k or 15k. But then, I didn't say we're back to normal, did I? At least the number is going up, caused among other reasons by rising mortgage rates and FOMO - Fear Of Missing Out. Those mortgage rates – and lack of reasonably priced inventory – caused a major drop in residential mortgage application: minus 32% compared to the same time last year. That in turn got sellers nervous, rushing to hop on the gravy train before it leaves the station. But, as I told a very nice prospective client from Hollywood who gets nudged by a neighbour to sell: if you don't move out of state, you have no business of selling. Even downgrading could cost the same, but with lesser quality housing. PENDING INVENTORY: properties in contract which haven't closed yet. Average time from signing to closing is at least three weeks for cash purchases, and easily double that with a mortgage. That number will likely not head north for at least another one or two months. CLOSED SALES: fewer homes for sale of course results in fewer closings. If pending numbers will take a month or two to stabilise if not go up, closings will take even longer. As an analogy, think of the turning radius of ships: a tug boat is nimble, a small freighter much less so, while a super tanker the size of the Exxon Valdez needs at least a mile to turn, rudder hard over. MEDIAN TIME TO CONTRACT: This is an interesting statistic we in the business call DoM or Days on Market. It means what it says: how many days was the property active until it went pending. 11 days is insanely fast, and I chose median on purpose, as average would have way too many outliers. Pre-covid, the number was typically in the 30s. MEDIAN % OF LIST PRICE: How much of what they were asking did the sellers actually get? In an overheated market as we had for the last 20 or so months, the median reached 100% in summer last year, dipped a bit and now is at 100% again since February. It means there were plenty of properties selling above list price - good for sellers if they moved away - however you will see that number decrease very soon. Typical is between 95% and 97%, meaning buyers negotiated between 3% and 5% off asking. As always, desirable homes have to be discounted less, while oddballs have to swallow the bitter pill (or "swallow the toad", as we say in German). Remember: it's not the seller who dictates the price, it's the plethora or absence of buyers who make the market. MEDIAN SALE PRICE: just what it says, the median of all 4,096 SFH sold in May. Important for you to frame the data: a healthy annual appreciation in a normal market in Florida hovers between 4% and 6% median. And: why median sales price? Answer: Because of the spread in our market; too many outliers which distort averaging. To illustrate – and bear with me, we're getting into a bit of research – I'll use homes currently for sale, and closed homes in May. For Sale: The lowest-priced SFH for sale today is listed at $60,000 (don't ask; you do not want to see it), the highest is $170m. The resulting average asking price of all homes listed today is $2,167,408, while the median price is $820,000. Neither $60k nor $170m is typical, but how many atypical listings do you eliminate? All four over $100m? The lowest four as well? Every month? Closed Sales: The lowest-priced home sold in May for $45,000, the highest for $49,500,000. The resulting average selling price is $999,922, the median is $595,000. With nearly 100% difference, do you see why in our market with super-expensive listings, only median price data make sense? In our housing market in South Florida the shift was caused by

If you're still reading: wow - thank you so much for your patience and interest! Feel free to post any questions or comments here, or contact me directly at 954 834 3088 or via email. Be well! By definition, a transformation is "a marked change in form, nature, or appearance." Here is an excellent example from the world of real estate:

This week I came across a modernist house on the MLS that stopped me in my tracks, with its interior so bizarrely overloaded and decorated. I even thought about possible using it in my "Bad MLS Photo" series. Not so – I repent. Going through all listing photos again yesterday, I became curious: what exactly was the current owners' starting point? Then going through the MLS photos from the last sale in 2016, I knew I found something share-worthy. Only a few photos clearly show old v. new (pix #3-10) since the floorplan was expanded, walls moved and windows closed or changed. But – irrelevant of my own taste – from what I can see, the current owners deserve major kudos on what they created out of pretty much run-down mid-century modern house. What do you think? (3 bedroom/2 bath renovated mid-century modern in Miami, asking $670k. Listing courtesy of Angie Homes) |