|

THE SINGLE FAMILY HOME MARKET Yes, there are still plenty of condominiums for sale. Yes, there are still many foreclosures, and a shadow inventory (properties not official on the market) of unknown proportions. But for now, cherry-picking time is over. At least thats what my observations during everyday searches for clients say and what statistics confirm. The market for single family houses in Southeast Florida has turned:

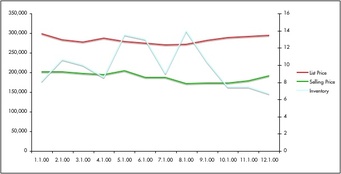

It seems I was too skeptical when I wrote in May I am not quite sure where some of the exuberant reported data on our regional market in April come from. The market for all single family houses in May: * Houses for sale: 22,025 (0.2%) * Inventory: 6.7 months (10%) * Median list price: $294,300 (+1.0%) * Median list price per sf: $142 (no change) * Houses sold last month: 3,308 (+5.8%) * Median selling price: $ 191,333 (+7.2%) * Median selling price per sf: 102 (+3.0%)  Table: all single family homes per SEF-MLS; data per month’s end. Percent changes are month-over-month. – Chart: SFH data May 2010 to May 2011. Red: median list price, green: median selling price, blue: that's the dwindling inventory, in months. – Data source: SEF-MLS THE MODERN HOME MARKET As always - read: since I write this blog - the modern market precedes the movement of the overall market. That can be interpreted good or bad currently bad for buyers, as there are less and less modernist homes to choose from. Inventory is dwindling monthly if not weekly, in May dropping the sixth month in a row. Not a nice record to write about if your expertise and speciality is promoting and brokering modern architecture. Compared to one year ago, in the most active price range under $500,000 there are 45% (!) fewer modern houses for sale. Translation: tough times for buyers, who will have to be patient to find the right property and ready to react – viewing it, finances lined up, and writing an offer – as soon as it becomes available. Owners and sellers of modern homes: please contact me so we can meet for a cup of tea and a chat. Please! In summary: against all intuition (and the arguments of some of my clients, savvy investors in their own right), June has been the month with the highest number of closings in South Florida – at least during the last four years. I’ll let you know as soon as possible if this holds true for 2011 as well. --- In the meantime, thank you for reading this blog, let me know if you have any questions - and stay cool!

0 Comments

Several real estate markets are starting to show signs of improvement with home prices in the last quarter as the industry demonstrates more signs of stabilizing, according to Clear Capital's latest monthly Home Data Index Market Report.

REO saturation rates have improved in the majority of the country’s largest markets. However, many areas are still battling year-over-year price declines. Clear Capital’s index reports that quarter-over-quarter home price declines were 2.3 percent in the latest quarter, which is less than half compared to the previous month. “The latest market report results through May suggest that home prices are starting to ease back from the heavy declines seen over the winter,” says Alex Villacorta, director of research and analytics at Clear Capital. “We are still far away from the strong demand needed to fully turn things around for the housing market. However, it is clear from the initial spring sales data that prices are softening, suggesting stabilization in the market." The High Performers Seven of the top 15 markets posted quarter-over-quarter property price gains in this month's report, compared to none in last month’s, according to Clear Capital. Here are the seven highest-performing major real estate markets, according to the report. 1. Washington, D.C.-Arlington, Va.-Alexandria, Va. Quarter-to-quarter home price change: 4.5% Year-to-year price changes (May 2010-May 2011): 4.9% REO saturation: 17.5% 2. St. Louis, Mo. Quarter-to-quarter home price change: 2.2% Year-to-year price changes: -11.4% REO saturation: 35.3% 3. Pittsburgh, Pa. Quarter-to-quarter home price change: 1.6% Year-to-year price changes: 0.3% REO saturation: 10.9% 4. New York, N.Y.-Long Island, N.Y.-No. New Jersey, N.J. Quarter-to-quarter home price change: 1.5% Year-to-year price changes: 1.4% REO saturation: 9.6% 5. Virginia Beach, Va.-Norfolk, Va.-Newport News, Va. Quarter-to-quarter home price change: 1.4% Year-to-year price changes: -13.2% REO saturation: 22.4% 6. Miami-Fort Lauderdale-Miami Beach, Fla. Quarter-to-quarter home price change: 0.6% Year-to-year price changes: -5.2% REO saturation: 39.6% 7. San Jose-Sunnyvale-Santa Clara, Calif. Quarter-to-quarter home price change: 0.5% Year-to-year price changes: -5% REO saturation: 25% Tthe lowest-performing market for the fifth straight month was Detroit-Warren-Livonia, Mich., with a 13.2 percent decrease in quarter-over-quarter home price change and a 58 percent REO saturation rate. Source: “Clear Capital Reports Quarterly Home Price Decline Slows; Signs of Market Stability as Summer Approaches,” Clear Capital (June 9, 2011) via Realtor.mag |

AuthorTobias Kaiser works as an independent real estate broker and consultant in Florida since 1990. Always putting his clients' interest first, he specialises in modern Florida homes and architecture, as well as net leased investments. Archives

April 2024

|

- Home

- Modern Homes for sale

- Selling a Home

- Inquiries

- Why Tobias Kaiser?

- Contact

- "Modernist Angle" Blog

- Services we offer

- South Florida City Profiles

- Intro to Modernism

- Modern Styles explained

- Elements of Modern Architecture

- Preservation

- Real Estate FAQ

- Deutsche Seite >

- Net-Leased Investments >

- About Tobias Kaiser

|

|

KAISER ASSOC, INC • LIC FLORIDA REAL ESTATE BROKERS & CONSULTANTS

dba MODERN FLORIDA HOMES • 370 CAMINO GARDENS BLVD • BOCA RATON, FLORIDA 33432, USA TOBIAS KAISER, MSc, CIPS • REALTOR/BROKER • MODERN ARCHITECTURE SPECIALIST MEMBER NAR, RCA, DOCOMOMO, NCMH • EMAIL • (+1) 954 834 3088 ZERO DISCRIMINATION: Kaiser Assoc. and its agents will not discriminate against any person because of race, color, religion, sex, handicap, familial status or national origin in the sale or rental of housing or lots, in advertising the same, in the financing of housing in the provision of real estate brokerage services, in the appraisal of housing, or engage in blockbusting. Kaiser Assoc. strictly adheres to the National Association of Realtors© Code of Ethics and Standards of Practice in accordance with Federal Fair Housing Laws. "SILENCE IS CONSENT": As a multi-cultural office neither do we silently consent to nor do we tolerate any type of discrimination, racism or prejudice. We strive to listen and learn what needs to be done to implement permanent change. Site design + contents ©Tobias Kaiser 2024. PUBLICATION, USE OR REPRODUCTION incl. parts ONLY WITH WRITTEN PERMISSION. |

RSS Feed

RSS Feed