|

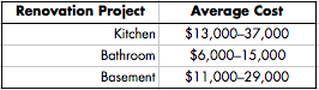

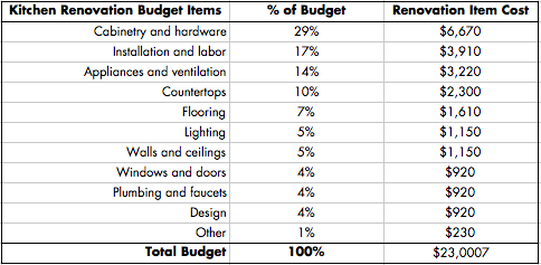

Home remodeling and renovation is a subject dear and near to home owners–even more so when the housing market is hot and dollar signs are luring potential sellers. But home owners are often uncertain which part of the house needs love the most. This is especially true for modern homes, whenever they were built: in the 50s, 60s or 70s, or just 15 years ago. Period-correct improvements to modern homes are not necessarily expensive, but: a generic Home Depot kitchen is less effort then contacting a consultant like me first or digging on the web for a new kitchen which matches your Parker-, Tschumi- or Duckham-design. Unfortunately, the results always and inevitably show which path the owner took. The other big obstacle for nearly every home owner is budgeting a renovation. Below, the finance advisory site Ramsey Solutions explains very well how to plan a budget for any home improvement project. You’re excited for your home renovation project—maybe you’re planning something small, like installing a new kitchen floor. But wait—the new floor will clash with the cabinets, so you decide to update those too. And while you’re at it, you might as well add a gorgeous kitchen island. Before you know it, your $2,000 dream renovation project spiked up to $20,000—yikes! To take control of your home renovation budget, you need a plan. If you want to complete a beautiful renovation without going bankrupt, this article will show you how to create a smart budget and make smart decisions that add real value to your home. How Much Does It Cost to Renovate a House? Depending on the type of room you renovate, where you live, and whether or not you’re confident with a hammer, your renovation project could cost around $10–60 per square foot, with some projects costing up to $150/sf. But what does that add up to exactly? Example: If you live in a cozy 1,000 sf home, renovations will probably cost $10,000–60,000, while renovations on a 2,000 sf home could cost $20,000–120,000. Good thing you’re planning ahead. Keep in mind, many factors make up the cost of a home renovation—including room size, type of work needed, cost of materials and how big the project is. For instance, if you’re hoping to convert your basement into a bowling alley with bar or put a jacuzzi on your roof, the cost of your project might be drastically different than the average. Here’s an example of how much it costs to renovate by project type: So if you want to renovate your kitchen, bathroom and basement, it could cost $30,000–81,000. But if your bathroom takes priority, zero in on that project and put the others on hold. The smartest way to create a home renovation budget is to lay out all the renovation projects you want done and price them. Get bids for each individual project, then rank them according to priority and start a detailed budget for the project you want done first. How Much Should I Spend on a Renovation? As a rule of thumb, don’t go crazy spending half the price of your home to renovate a room or two—that probably won’t add a balanced value to the house. The smartest way to decide how much to spend on a home renovation is to look at your current monthly budget and go from there. Let’s say your household income is $80,000/yr. and you live in a $250,000 home. Ideally, you‘d like to make $60,000 worth of renovations to revamp a few rooms, evict the squirrels from your attic, and repair the racoon damage to your roof. If you can save $2,500 a month for renovations, you can tackle half of them within the first year of saving! You also should ask yourself how long you plan to live in the house you're in: are renovating for your own benefit or do you want to sell within a year or so and increase marketability? This will determine the scope and priority of your renovation project list. How Do You Pay for a Home Remodel? If you want to be smart about paying for your renovation project, cash is the only way to go. Sure, you’ve probably heard of fancy financing options that get you into debt—like a home equity loan or a home equity line of credit (HELOC). But debt is dumb! Renovations aren’t worth borrowing what you already own of your home (which is called equity) to pay it back—plus interest! (An annual report Tobias subscribes to not only shows the average cost of 22 home improvement projects in different regions of the US––it also shows how much can be recouped when selling. Which by the way is never 100% or more! Ask Tobias for details if you are considering any remodeling project, especially if the style of your home is modern.) If you currently have consumer debt, you’re better off focusing on paying off your debt first and saving up an emergency fund of 3–6 months of expenses before tackling renovations. Then, you can take the amount you were paying into your emergency fund and use it to save for renovation projects. You’ll save yourself so many headaches by paying in cash—not to mention, your home renovations will feel like a blessing instead of a curse. A budgeting app like Ramsey Solutions' EveryDollar can help you control your monthly spending and save cash for renovations faster. Home Renovation Budget in 3 Steps To get your project moving, use these smart steps to create your home renovation budget: 1. Prioritize Projects Obviously, if a room in your home is out of whack and causing trouble, you’ll want to budget for that project first. Or if you have a strong desire to renovate a particular space, go for that one first. But if things are otherwise even, consider starting with popular home renovations that add the most value to your home and bring the most satisfaction to homeowners. Home value: If your primary purpose is to increase home value, prioritize projects that will earn you more money at your home sale than you spent on them. For example, projects like new roofing and new wood flooring earned renovators 6–7% more at resale than they spent on the projects. New roofing also ranked the highest of 20 renovation projects for helping to close a sale. Enjoyment: If you care more about enjoying the results of your renovation project, whether or not it earns back the full amount you spend on it when you sell your home, you could choose projects like a kitchen or closet renovation, which both scored the highest of 20 projects for homeowners who were happy with their renovations. (Contact me to learn for free about the cost-versus-value equation of the project you might consider.) 2. Outline Cost Estimates Now that you’ve decided which renovation to do first, break down the cost of everything that goes into that project—including all the labor and materials needed. This will take some research, so grab a cup of coffee and get cozy. Keep in mind, you won’t be able to get an exact cost until you talk with actual contractors (see #3). But digging around online will give you ballpark figures so you can be realistic about what you can get done with your budget. If you’re doing a kitchen renovation, your budget breakdown might look something like this: This will give you a better idea of how much money goes where for your renovation project. It can also show you how to cut back costs in some areas to splurge in others. For example, you could skip the new flooring and use that money to get fancy marble countertops instead. 3. Collect Contractor Bids Now you’re ready to talk to a contractor. Ask around or search online for at least three legit contractors in your area. Request project bids and timelines from each one and compare pricing. Be careful not to only be tempted to go with the lowest bid—you might end up paying for a shady character who takes several lunch breaks a day and leaves you with a half-finished project. But if the contractor checks out and the bid fits your price range, go for it. How Do I Cut Renovation Costs? One of the best ways to lower your renovation costs is to tackle home projects yourself—DIY. In 2021, more than a third of homeowners actually did their entire renovation projects by themselves! If you’re not comfortable handling every part on your own, you could still knock off some costs by doing one or two of these tasks yourself: DIY Demolition. You could cut the first part of labor costs by ripping out old flooring, tearing down drywall or removing cabinetry—and you might even have a blast doing it! Shop for low-cost materials. In 2021, 14% of homeowners purchased materials on their own and then hired out the labor. If you really want to save money, this gives you more control over how much you pay for materials. But talk this over with your contractor first, so you can make sure the materials fit your plan. Hire your own subcontractors. If your job requires multiple types of contractors, your contractor might recommend subcontractors who aren’t your best option price-wise. But if you handle finding subcontractors yourself, you can hunt for the best deal. Then again, some contractors have a set team they work with, so check with your contractor first. DIY paint job. It can cost anywhere between $200–800 to hire someone to paint a typical 120 sf room—but DIY costs $100–300!10 So you could save half the cost by picking up a brush to paint the room yourself! Sell Your Home With an Agent Who Knows What to Renovate If you’re renovating with the intent to sell your home in the next 12 months, get advice from a top-notch real estate agent in your area. (This is especially true when renovating a modern home, where there's no room for cheap & wrong remodels). An expert agent will help you decide which renovations are worth top dollar, and they’ll negotiate the best deal for you when it’s time to put your home on the market. __ If you have any questions about a home remodel project, or if you're uncertain if you should renovate or move, contact Tobias Kaiser of Modern Florida Homes for a free consultation. "Move or Remodel: How to create a Home Renovation Budget" by Ramsey Solutions, edited and updated by Tobias Kaiser, CC BY-NC-ND

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorTobias Kaiser works as an independent real estate broker and consultant in Florida since 1990. Always putting his clients' interest first, he specialises in modern Florida homes and architecture, as well as net leased investments. Archives

April 2024

|

- Home

- Modern Homes for sale

- Selling a Home

- Inquiries

- Why Tobias Kaiser?

- Contact

- "Modernist Angle" Blog

- Services we offer

- South Florida City Profiles

- Intro to Modernism

- Modern Styles explained

- Elements of Modern Architecture

- Preservation

- Real Estate FAQ

- Deutsche Seite >

- Net-Leased Investments >

- About Tobias Kaiser

|

|

KAISER ASSOC, INC • LIC FLORIDA REAL ESTATE BROKERS & CONSULTANTS

dba MODERN FLORIDA HOMES • 370 CAMINO GARDENS BLVD • BOCA RATON, FLORIDA 33432, USA TOBIAS KAISER, MSc, CIPS • REALTOR/BROKER • MODERN ARCHITECTURE SPECIALIST MEMBER NAR, RCA, DOCOMOMO, NCMH • EMAIL • (+1) 954 834 3088 ZERO DISCRIMINATION: Kaiser Assoc. and its agents will not discriminate against any person because of race, color, religion, sex, handicap, familial status or national origin in the sale or rental of housing or lots, in advertising the same, in the financing of housing in the provision of real estate brokerage services, in the appraisal of housing, or engage in blockbusting. Kaiser Assoc. strictly adheres to the National Association of Realtors© Code of Ethics and Standards of Practice in accordance with Federal Fair Housing Laws. "SILENCE IS CONSENT": As a multi-cultural office neither do we silently consent to nor do we tolerate any type of discrimination, racism or prejudice. We strive to listen and learn what needs to be done to implement permanent change. Site design + contents ©Tobias Kaiser 2024. PUBLICATION, USE OR REPRODUCTION incl. parts ONLY WITH WRITTEN PERMISSION. |

RSS Feed

RSS Feed