|

Hurricane season in Florida commenced yesterday, running through 30 November, 2022.

Well – if you don't live here and shrug your shoulders, imagine this: It's late autumn and you haven't mounted your winter tires yet. All of a sudden you hear that there are 8 inches (20 cm) of snow forecast for tonight. Would that grab your attention? If you get ready for hurricane season now, you will be so much more relaxed during the next few months, basking in the wisdom you're ahead of the curve. To sweeten the pot a bit: until June 10 there's a Tax Holiday, exempting certain items from Florida sales tax. The exempt list, in case you need supplies, is on a website of the Florida Dept. of Revenue (click on "Consumers"). What should you get then? There are so many downloadable supply lists that I won't post any of mine – every county and major news site has them, so pick one that makes the most sense to you. Check out your county's website below now, store the local emergency numbers in your phone, and download a good hurricane warning app on your phone. NOAA or Florida Storms (operated by FL Public Radio) are among the many good ones and available for both Android and iOS.

If you have any valuable tips or links you believe are worth sharing – please post them. Thank you and be safe! – L: Hurricane Georges, Deerfield Beach, Florida 1998; R: "No Lifeguard on Duty" Hurricane Irene, Fort Lauderdale, Florida, Oct 1999, both ©tck

0 Comments

Question: Over Easter dinner, I overheard someone - I think he was a Realtor - explain to a friend why he should have an home inspection done before listing his house. Isn't that wasting money? I always thought the buyer does the inspection? Answer: You overheard sage advice. I'll explain. Correct: buyers conduct their own home inspection to evaluate if a property has any functional flaws which might make them re-consider the purchase (note: in Florida, home sellers must disclose any major defects they know about or should know about – like a constant drip from the ceiling the seller decides to ignore and hope for the best). But a seller's pre-listing inspection is not of money thrown out the window – on the contrary! A seller’s inspection, also called a pre-listing inspection, gives sellers a clear understanding of the condition of their property. They then can fix any issues before putting the home on the market, or price repair and inconvenience to the buyer into the asking price. So it's not money thrown out the window!

I always suggest a pre-listing inspection to save my sellers money, aid in the efficiency of the transaction, and especially to reduce surprises that always – note: always! – arise from the inspection. But despite being such a great tool, it’s very often rejected. 5 Key Benefits: 1. Uncover any issues A pre-listing home inspection provides sellers a clear understanding of the condition the home. Sellers can’t and don’t know everything that needs attention in their home, even if they think so. The inspection report lists all the issues the seller can address and fix prior to placing the home on the market, or lay out the issues to potential buyers up front. This results in saving the seller time and especially money – see below. 2. Save Money, reduce seller stress, prepare to negotiate Seller’s inspections generally cost the same as a buyer’s inspection. But the inspection can provide immense value. Instead of having only a few days to fix problems after a buyer's home inspection, the pre-listing inspection will alert the seller of issues before the home is put on the market. This provides the sellers plenty of time to compare costs of repairs and negotiate prices without having a time constraint. Typical example: nearly house has electrical problems that surface during an inspection. These items can seemingly add up to substantial amounts, because electrical issues are typically health- and safety-related, and inspectors err on the high side when estimating repair costs. However, when we have the ability to bring out a reliable electrician ahead of time, he can provide a true bid which is nearly always less than a buyer’s estimate. The seller then can have items repaired at a lower cost and without time constraints. But even with pre-listing inspection reports, many buyers will opt to conduct their own inspections. Having a pre-listing inspection report in hand helps alleviate seller stress, because we already know what the other inspector will likely find, and we have already investigated related costs. Also, by providing full disclosure upfront, along with any repairs that were made, buyers will have acknowledged the existing condition of the home. This reduces the risk of buyers from coming back to the seller and asking for more money off the sale price. Fact: Avoiding repair surprises is a good thing for all homeowners, even those with no intention of selling. That’s why I recommend all homeowners periodically order inspections to confirm they’re maintaining their home in good condition. 3. Boost marketability, build buyer’s trust Trust starts with a good first impression, and transparency is a key driver in trust. Pre-listing inspections underscore that the seller is a proactive homeowner who cares about the home and has maintained it. In addition, sharing inspection reports from the outset sets up the expectation that the seller is communicating honestly with the buyer. 4. Encourage “cleaner” offers with reduced contingencies In the current real estate market with very limited inventory, qualified homebuyers know they will likely have to compete aggressively. For the best properties in the most popular neighborhoods, buyers sometimes need to make quick decisions and limit contingencies to be competitive. One of the goals of pre-listing inspections is to help homebuyers feel comfortable about eliminating or least reducing physical inspection contingencies. 5. Calm buyers' nerves during escrow The best time to tell a buyer about property concerns is upfront, when buyers are most interested in the home and likely competing with others to purchase it. Pre-listing inspections allow buyers to see any solved or potential issues upfront, so they know there shouldn’t be a massive surprise if and when they conduct their own inspection. ___ Questions, experiences? Let me know please! Many years ago when I was to start my blog “The Modernist Angle”, my ex-wife and I – we worked together then – discussed those two terms at length. What sounds like a First World Problem is in reality a bit like cooking: if you’re sloppy in the details, it comes back to bite you later.

And even though folks frown upon a native German (that would be me), throwing around English words he barely understands and can hardly pronounce in his native language, not to speak of English, there is a reason I prefer “Modernist” over “Modern”. Back then, we found an interesting forum where the pros differentiated between those two terms carefully, the former referring to a style or aesthetic, while the latter – modern – meaning “something current”. “Takeaway lesson: There's an important difference between 'modern' and 'modernist'. Modern means nothing more than 'current' or 'recent'. Modernist means... the ideology of modernism... an aesthetic movement that emerged in Europe during the interwar period”. (–Ray Sawhill, on the Visual Resources Association Forum) Adding to the point: “Modernist is ultimately a more valuable and specific term for us than the more generic Modern. Modernist is our stylistic term of choice, whereas Modern seems more like a state of mind.” (–Dane A. Johnson, Visual Resource Coordinator, College of Architecture and Design, Lawrence Technological University, Southfield, MI, on the Visual Resources Association Forum) Thus, a mid-century design by Richard Breuer or Ludwig Mies as an example should really be referred to as Mid-Century Modernist. Though nobody does that, as a client reminded me when he snubbed all homes older than five years, disregarding their modernist styles. With my own firm’s residential arm being named “Modern Florida Homes”, and its mission being “Brokering, Promoting and Preserving Modern Homes and Architecture”, an important step for me was to check the prevalence of either term in colloquial usage. “Modern” was the clear favourite. So I use “Modern” in the website name and mission statement, but on social media and especially in a verbal context where one can discuss, explain and elaborate, I prefer “Modernist” as the correct and more precise term. Fun question to ask your favourite architect, isn’t it? – You do have one, don't you? The prominent architect, born in 1926 as Charles Reed, Jr., died 3 February 2022 in his home in Raleigh, NC. He is survived by two daughters, one of which was at his side when he passed away. Returning from service in World War II, Chuck Reed enrolled under the G.I. Bill (U.S. government sponsored education and training program for returning war veterans) in the University of Miami Architecture program and was scheduled to finish in Miami’s second graduating class. At the time, formal education was only one way of becoming a qualified architect; the more traditional “atelier” system of internship under a practicing architect was fully recognized, and the system followed by many of the greats, including Frank Lloyd Wright. Reed met architect Igor Polevitzky and began working in his firm as a draftsman. According to a City of Hollywood oral history recorded in 2004, Reed did many of the details for the Polevitzky home at 1519 Harrison Street. He went on to practice independently and designed a number of revolutionary residential works in Hollywood Hills and North Central Hollywood. His work typically utilizes structural materials like concrete block, colored and clear glass block, and exposed beams (usually glue laminated wood beams) in a highly detailed, but minimalist manner. Joints, where wall meets ceiling or materials merge are elegantly simple. The use of screened areas and open air partitions are also signature gestures of his work. He was the key subject of an architectural symposium focused on the Mid-Century Modern movement and the design of Florida Tropical Homes as part of a 2004 Historic Preservation Week held in Hollywood. Some of his many commissions include the Jaffe-Garrett House c. 1959, the Heller House II known as the “Birdcage” house, on Miami’s Venetian Causeway, the Havana Riviera Hotel in Havana, the Heiden House, the Gahstrom House 1952, the Simon House c. 1957, the Ritchie House 1958, the String House 1959, the Hulmes House 1956, the Brill House 1959, the Wicker House 1959 and the Lawson House 1960. I was fortunate enough not only to broker two of his commissions, but even more so to meet Chuck and his lovely and wonderful wife Elaine, a renown artist. I own a beautiful sculpture of hers, a handpainted clay piece, and spent private time with them in Raleigh on numerous occasions. A very humble and approachable gentleman, Chuck just loved talking architecture, showing me sketches, elevations and floor-plans, and he enjoyed explaining his thoughts behind solutions I would query him about. Inevitably, Elaine would come into the study and ask if Chuck wasn't boring me. Nope. Stories about his clients and their connection were so fascinating, I always made notes on napkins or whatever I could get a hold of, just so not to forget a specific construction detail or a funny story about weekly meets, hanging out at a clients' house long after it was completed. I feel immensely privileged and honoured to have met Chuck and Elaine, and both sharing with me a bit of their creative and their private lives. I so enjoyed spending time with both of them – and I do miss them quite a bit. As a photo illustration for my New Year's greeting, I originally thought "fireworks with a modernist house" – but no such luck. What I did find is this lovely composite shot by Matt Hudson (matthudsonau) of the iconic Sydney Opera House.

But I immediately realised how little I knew about this very distinctive building and masterpiece of 20th century architecture. Worse, I didn't even know anything about its architect. Thus, a short intro: An international design competition for a new multi-venue performing arts centre in Sydney was launched in 1955 and received 233 entries, representing architects from 32 countries. The criteria specified a large hall seating 3,000 and a small hall for 1,200 people, each to be designed for different uses, including full-scale operas, orchestral and choral concerts, mass meetings, lectures, ballet performances, and other presentations. The winner, announced in 1957, was Danish architect Jørn Utzon. His design was rescued by Finnish-American architect Eero Saarinen from a final cut of 30 rejects. Utzon visited Sydney in 1957 to help supervise the project; his office moved to Sydney in February 1963. The Government of New South Wales authorised work to begin in 1958, with Utzon directing construction. (But) the government's decision to build Utzon's design was often overshadowed by circumstances that followed, including cost and scheduling overruns, as well as the architect's ultimate resignation. Completed by an Australian architectural team headed by Peter Hall, the building was formally opened in October 1973. Utzon received the Pritzker Prize, architecture's highest honour, in 2003 for his design. The Pritzker Prize citation read: “There is no doubt that the Sydney Opera House is his masterpiece. It is one of the great iconic buildings of the 20th century, an image of great beauty that has become known throughout the world – a symbol for not only a city but a whole country and continent.” Have you visited the building? And if so, what is your impression and take on it? ____ Via wikipedia; much more details at https://en.wikipedia.org/wiki/Sydney_Opera_House, and about every architectural site on the internet. Insider Guide to Real Estate Transactions in Florida, ch. 6: FORECLOSURES and SHORT SALES16/12/2021 In chapter 6 of my “Guide to Florida Real Estate Transactions” (the series started in April, in case you missed the first chapters) we talk about the possibility of getting a deal through foreclosures or short sales. Foreclosures – also referred to as REOs – and Short Sales follow a slightly different path than offer and contract in a normal “arms-length” transaction with no duress. Both Foreclosures and Short Sales are time-consuming, often complicated and never for the faint of heart. A Short Sale is a bank-approved sale before a property goes into foreclosure, fetching a price under of the current mortgage value, thus the “short”. Contracting partner and seller is the current owner of the property, though the lender has to agree to the contract and is the factual negotiation partner. Because the bank hopes to minimize its loss, it will look for the best and highest offer as with as much time as possible and try to bid up offers. So a short sale is anything but short: a time-frame from three to seven months from submitting an offer to closing is typical. Short sale asking prices are teaser prices; selling prices normally are substantially higher. Cash offers with no contingencies are preferred, or the other way around: if the buyer doesn’t have cash in hand or at least bulletproof financing lined up and/or asks for inspection contingencies, he is wasting time. A variation, not common though, is a pre-approved short sale, where the bank has agreed to sell the property at a specific price. The pre-approval should always be obtained from the bank in writing, everything else is useless. Foreclosures happen when there is no short sale and the property gets auctioned off at a local Court of Law. This often happens when a property owner is in serious arrears with property taxes. In such case, an investor may jump in, pay off the taxes and as a result hold a tax certificate, which then can lead to ownership of the property. I recently had a case of Hollywood home with every functional and cosmetic deficiency in the the book; to make matters much worse the seller “forgot” to tell me that her taxes were three years overdue and someone already held the certificate. Lesson: it is vital to verify all taxes are paid and current.

Foreclosure- and Short Sale-properties are usually in disrepair and may be uninhabitable due to vandalism, mold, roof damage, missing sinks, toilets, pipes, appliances etc. In such case, no lender will finance the purchase. A buyer can not expect price concessions due to necessary repairs and must deal with visible and hidden problems on his own. Savings in buying such property are often eaten up by repairs, which can not be financed. Lastly, liens, second mortgages, unpaid taxes, utility bills, homeowners or condominium dues and open judgments can significantly add to what only looked like an attractive price at the beginning. In the case of the Hollywood home above, a last-minute sale to an investor prevented the certificate sale, but resulted in a substantial amount of money the seller left on the table. At the end of the day, a Foreclosure or Short Sale may not be significantly cheaper for a user (vs. investor) than buying a property on the free market, which doesn’t come attached with massive headaches. Comments? Questions? Please contact me anytime; I'd be delighted to assist you. ____ ©2021 Tobias Kaiser. Use or reproduction only with written permission. You may be like me and have a plethora of work tasks to be tackled frequently or just once, in urgency ranging from “I’ll be in the sewer if I don’t do it now” to “Oh well, whenever I feel like it”. If you don’t have that problem you’re a person of leisure or a total slacker. Go read something else. For a daily task overview – step 1 – my tool of choice is home-brewed and Excel-based. Decidedly not elegant, but it works really well for me and also my assistant, to a point where someone from Apple’s Business Software division once commented “what you created doesn’t exist as a ready-made software solution.” My addition of a complimentary tool, step 2, is an egg timer of sorts, a re-discovery for me. Read: At some point in time I must have been really smart but then dumbed down. But only a tiny bit. Now I’m smart again. – Sigh of relief! The timing tool is called a Pomodoro Timer, in my case an app for Macs and Windows called Tomighty (https://tomighty.github.io). But any timer works. The idea behind the Pomodoro technique is to break up tasks into specific segments with short breaks in between. Francesco Cirillo, who invented it, uses 25 min segments with 5 min breaks in between and longer breaks every 90 min. Pomodoro, the Italian word for tomatoe, comes from Cirillo using a kitchen timer in the shape of a... – yes, you guessed right. Brownie point! I used a Pomodoro freeware app years ago and loved it. But when Apple’s constant OS upgrades left that app behind, I somehow couldn’t find a good replacement. Last week, trying out several timers parallel, I did. And I love it. The way it works and the preference options are perfect for me, and (on a Mac) it sits in the menubar, which I prefer over a desktop floater.

The effects of the Pomodoro timer on my workflow are multiple: • I realise how much time I need to complete tasks and get better in planning out my work time, • Even though not having ADHD, I’m considerably more focused and don’t doodle (at least not as much: progress), • I get my tush off the chair in regular intervals and give my back, neck and eyes a break (meaning: no screen time during breaks), and • After a week of use, I still crack up about the sound indicating a segment is over. But then, I’m easily entertained. Try it out; highly recommended! What tools or technique do you use to get things done? In this series of posts about chance encounters and interesting observations – all connected to modernist architecture or design – I highlight details, solutions and examples I find note- and share-worthy. Whenever I gather enough, I publish a new post.

Do bear in mind I’m neither trained as an architect nor as a designer, but growing up with an architect sibling, in a mid-century modern home, surrounded by MCM furniture, furnishings and art, influenced my taste tremendously and left a great interest in all things modernist. In Germany I recently observed three lovely details: - a bicycle rack in Munich, made out of a single continuous tube of stainless steel, - a window-shuttering system consisting of stainless rails with weather-proofed plywood panels stained in an accent colour, also in Munich, and - a staircase light in a museum in Penzberg outside Munich, elegantly hiding the fixture itself, made possible with the advent of LEDs. What do you think of each of these three solutions – do you like them? If so, what do you like about them? A very personal experience:

Charleston, South Carolina, June 2021 After visiting the incredibly eye-opening and educational Old Slave Mart museum, I stepped out into Chalmers Street, waiting for friends to meet me. The June sun torched sidewalks and cobblestones, I was early, so I decided to wait in the shade and plopped down on one of the two small benches flanking the museum entrance. After a few minutes another visitor leaving the museum asked if there was room for her to sit down too; apologising for being such a space hog I scooted over to make room. Then one of her friends came out to join her, so my seat buddy and I made space in the middle for the newbie to sit down. Both she and her friend were Black, both in their Fifties or Sixties. The new arrival joked about the stability of the bench – basically a wooden plank with end supports – now bending quite a bit under the weight of three adults. I laughingly responded that, just like in real life, we all sat in the same boat. A few minutes later, the lady in the middle turned to me and very politely inquired if she could ask a question. I stopped spacing out observing people, turned to her and said “yes, of course”. My neighbour proceeded by explaining the question had nothing to do with me personally, and that she actually felt it was ok to ask me. I only had an inkling that what was coming was not a tourist question about dinner recommendations. And so she asked: “Why do you hate us?” If my writing doesn’t paint the moment properly I am sorry: what her question meant was “Why do you Whites hate us Blacks?” I was floored by her question and speechless, by her trust to pose it to a total stranger, and also by a quiet sadness in her voice. Mentioning that I’m German, living in the US for about 30 years and considering it my second home country but couldn’t answer like a born American could, I responded spontaneously and truthfully: “I can’t explain it, and I do not understand it either.” Pause. Her eyes got wet, mine too, and for the next ten minutes or so the two of us spoke quietly about discrimination, race, fears and hope. Two total strangers, without introduction or preparation, engaged in a too-short dialogue, dropping barriers, and I felt extremely honoured that she had seized the moment and chose me to ask what was on her mind. My friends appeared. When my conversation partner’s group got ready to leave as I did, my new friend turned towards me and, waving goodbye, said "I want to marry you." Beam. to this day I regret not giving her my name and phone number or asking for hers. I so would have loved to continue our exchange. But I didn’t think on my feet. It was a magic moment, priceless, with an unexpected insight into each other’s experiences, feelings and thoughts. This lady, with her courage to approach a stranger with her question, touched me in a way I will remember as long as I live. – Thoughts? ____ ©tckaiser. Photo by ThriftDiving.com As the housing market in South Florida took off like a torpedo from August 2020 to August 2021, selling prices for single homes between Miami and Jupiter year-over-year increased by approx. 29 percent. Since late August or early September ‘21, there is the first hint of normalcy on the horizon – meaning a slow-down in price increases, though no return to previous prices. Unfortunately salaries didn’t increase by 29 percent at the same time – wouldn’t that be nice! – while the hottest price range still is approx. $350,000 to $800,000, mostly bought by owner-users (vs. speculators or snowbirds). At $350,000, currently there are unfortunately no modernist homes available for purchase, but as you go up in prices, selection and quality start to increase. Any of these homes shown below may be under contract by the time you read this post, but here is an overview of what you can reasonably expect in modern homes available for sale up to $800,000: 3/2 with 1,480 sf under air on a 6,050 sf lot, built 1962. – Charming vintage home, completely renovated, features tongue & groove wood walls and cathedral ceilings, red brick, Coquina coral walls, working fireplace, completely updated plumbing and electric, new metal roof, impact windows, laminate wood floors, large skylights and a private, tropical landscaped garden. #856506, asking $549,000 4/2 with 1,510 sf under air on a 6,380 sf lot, built in 1957. – Sited in a neighborhood with many mature trees, this open-concept house has been renovated with a new roof, new AC, new driveway and patio, new fence, new kitchen, new bathrooms, new impact windows and doors, new recessed lights inside and out and new landscaping in a large back yard. #424405, asking $615,000 3/2.5 with pool and 4-car garage, 3950 sf (363 m2) under air on 13600 sf lot, built in 1975. – Overlooking a golf course, this home boasts a detached master suite w/access to the pool, a designated wing with 2 bedrooms and cabana bath, an open kitchen, a billiard room with wet bar, two office spaces, library, laundry room, 4 AC units and a 4-car garage. #616803, asking $550,000 3/2 with 1,340 sf under air on a 6,750 sf lot, built in1956. – Steps from the Intracoastal Waterway, completely updated with new impact windows and doors, garage and circular drive. Open plan, light and bright. Original Terrazzo floors throughout. Plumbing and electrical updated, new HVAC, newer water heater and roof. Beautiful landscaping with plenty of room for a pool. #262301, asking $799,000 3/2 with 2,040 sf under air on a 10,230 sf lot, built in 1970. – A good example for ‘70s modern architecture in a popular golf course community, very well maintained, with eat-in kitchen, cathedral ceiling, formal dining room and an atrium. Newer refrigerator, a/c, water heater and washer/dryer; oversized 1-car garage. Low HOA fees. #939801, asking $499,000 Shared ownership of a 5/4 with 3,970 sf under air on a 10,120 waterfront lot, with pool, dock and garage, built in 2014. – Opportunity to acquire 1/8th (so technically it's not a $654,000 home, agreed) of a professionally managed, fully furnished and decorated home. Open floor plan centers around a great room opening to a covered deck. Chef's kitchen includes high-end appliances and a breakfast nook with a workstation. Primary bedroom is downstairs, upstairs are a sitting area and four guest suites. #399703, asking $654,000 (1/8th share)

What is your impression of the current housing market in South Florida? Have looked for a home and were outbid, or were you successful? Do you consider selling your home? In either case, I would love to hear from your comments or questions: 954 834 3088 or [email protected]. – Thank you, Tobias. ___ (All information from the respective listing agents via SEF-MLS). In chapter 5 of my “Guide to Florida Real Estate Transactions” (the series started in April, in case you missed the first chapters) I outline the main steps from inquiry to contract.

Because of the large number of available properties–even in this market in late summer 2021–on first client contact any experienced agent will not send out those nice brochures, or even run out and tour a sampling of homes. Rather, he will set up a client profile. This allows to offer a buyer only properties within his specific criteria and financial framework. Showing properties outside a buyer’s financial capabilities makes no sense and equals real estate tourism, with the agent being the unpaid tour guide and a frustrated buyer at the end of the day who saw during the tour what he’d love to have but can’t afford. – Bad approach! So if you are the buyer, your agent will assemble a list of properties suitable for viewing based on your criteria. Having toured a few–or many–homes and hopefully found one to your liking, your agent will present a written offer to the seller’s agent. The amount of this opening offer will be determined by your agent and you, based on a market analysis done by your agent. Please note: verbal offers or inquiries are generally considered unprofessional and disregarded. When your opening offer has been presented to the seller, he can accept, reject it or counter it within a time-frame you have specified. Your offer becomes only a contract when both parties agree and sign. Then a first deposit will be due, and as well as following ones it will be paid into an escrow account of your broker (agents are not allowed to open escrows), your lawyer or a title insurance company–but never to the seller directly. Only at closing–exchanging property title and keys against money–will all deposits be handed over to the seller together with the remaining balance of the purchase price. If the property does not close, all deposits will be returned to the buyer if he didn’t default. However, if the buyer defaults on the contract or changes his mind midway he looses his deposits; the seller may also sue for damages. In a resale (a “used” home), the buyer has those same rights against the seller in case of a seller’s default, in addition to requesting specific performance. In new construction, the cards are distributed differently: the purchase agreements for new homes eliminate major buyer’s rights, favor the builder and thus demand special attention with a very fine comb before signing. Real estate contracts have to be in writing and may contain any type of clause negotiated freely between the parties as long as they are legal. All time periods contained in the contract, such as the inspection or financing periods, commence with the last necessary signature of seller or buyer. Time is of the essence, and missing a vital date may constitute a breach of contract. It is good practice for an agent to prepare a time-line containing all important dates of the transaction. Comments? Questions? Please contact me anytime; I'd be delighted to assist you. ____ ©1996-2021 Tobias Kaiser. Use or reproduction only with written permission. What is it:

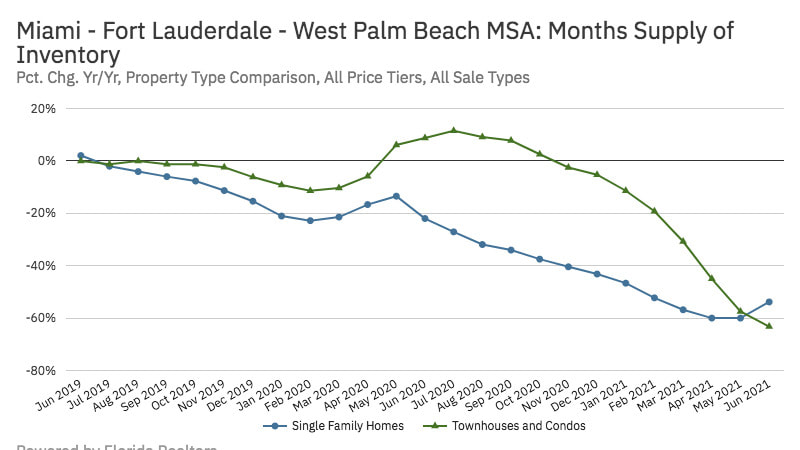

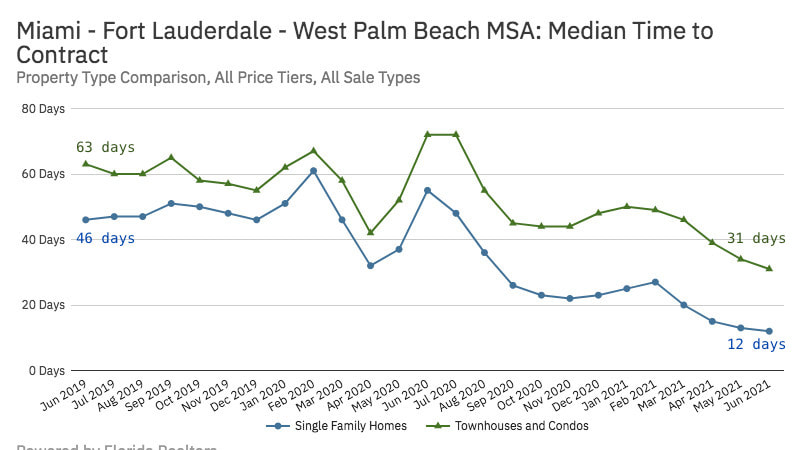

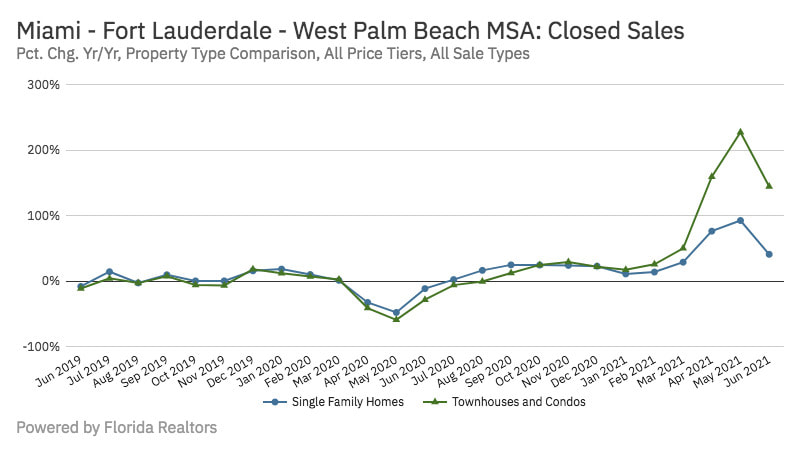

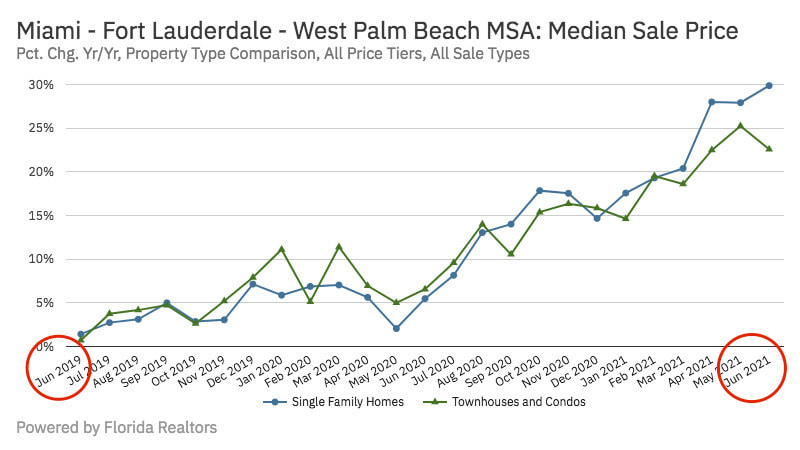

New two-story, 46,000 sf library, cultural center building and civic campus adjacent to City Hall, replacing the old library on E. Atlantic Boulevard open from 1952 until November 2017. The new facility features a standard library, media labs, 5,000sf of theater/flex event space and an exhibition gallery of 750sf. Construction included also a multipurpose room, three tutoring rooms, a group study room, conference room, storytelling/program room, computer lab and the Teen Tech Studio, which is designed to encourage young adults to creatively explore digital media. The new library houses a collection of approximately 50,000 items including books, DVDs, CDs, publications and reference materials. Site improvements included a new civic plaza featuring raised planter areas, street furniture, a lightning bolt plaza and a new paved breezeway connecting the parking areas to the civic plaza. What's its purpose: Located at the heart of a community where the average annual income is under $40,000 per family, the Pompano Beach Cultural Center & Library was developed to provide broad access to knowledge, technology, and 21st century tools for creativity. To that end the project was developed to combine the richness of a state-of-the-art public library, that is equal parts children and adult services, with a cutting-edge cultural arts and media center. This combination gives shape to a one-of-a-kind innovative teaching and learning center unprecedented in the public realm. For two different sets of clients, budgets, and management teams the programs are uniquely separate but symbiotic, and are arranged to complement one another, promoting innovation and collaboration. The technology at the library is intended to introduce users of all ages to new media with spaces such as the YouMedia lab for kids. At the Cultural Arts and Media Center, the public has access to production spaces and advanced classes enabling entrepreneurial activities and collaborative projects. (via MPdL) The original vision for the library did not include the cultural center, which was added during planning. When Redevelopment Management Associates (RMA) was engaged as the Executive Director of the Pompano Beach Community Redevelopment Agency, they placed an emphasis on arts and culture venues for reinventing the Old Town Pompano Beach area, and residents overwhelmingly favored including the cultural center in the project. Details: 25,000 sf Public Library; 21,000 sf Cultural Arts and Media Center Architects: Silva Architects with MPdL Studio Completed: 2018 Construction cost: $19.7 million, with about half of that amount going toward each facility. Funding for the project came from Broward County, the City of Pompano Beach and the Pompano Beach Community Redevelopment Agency. The library is located on land owned by the City of Pompano Beach. The County will occupy the library space via a 50-year lease with the City, with a 50-year option to renew. Contractor: OHL Building, Miami (with CBI and NV2A) Achieved LEED Gold Certification Awards: 2017 Unbuilt Merit Award, AIA Miami Design Awards 2019 AIA FL Merit Award of Excellence for New Work 2019 AIA Miami Design Award Hours: (please verify Covid-19-influenced hours and admission conditions before you go) 10a – 6p Monday – Saturday Closed Sundays 954.357.7595 or 954.545.7800 Events calendar: https://www.pompanobeacharts.org/cc Note: The popular Pompano Green Market will restart on Nov 13, 2021, from 9a to 2p, and from there on (hopefully) every 2nd and 4th Saturday. __ Have you been at the Pompano Beach Cultural Center and Library? Do you like it – or what is your impression?  Overall, the main trend of the regional residential market – more closed sales and higher median prices – continues, but now with more new listings and a slight easing of the buyers-to-sellers ratio. As we enter the second half of 2021, the first change indicators for somewhat calmer times are appearing. Because Florida started its lock down last year on April 1st, I compare statistics not with June 2020 but June 2019, the last "normal" pre-pandemic period. Mid- to late 2020, as people adapted into a rhythm of life with the pandemic, the recovering regional housing market was in most aspects a market on steroids, making up for the lost spring and early summer buying peak, and thus considered atypical. Geographically, I am analysing the Miami-Fort Lauderdale-West Palm Beach MSA (Metropolitan Statistical Area, a standard US urban and suburban geo-definition) - which consists of the three counties Palm Beach, Broward and Miami-Dade, locally also referred to as the TriCounty area. Inventory in months*, where 4-6 months is generally considered a balanced housing market: Dropping from 5 mos for SFH to 1.8 mos, and from 8 to 3.2 mos for Condos/TH. Active inventory: For SFH increasing from May'21 to June'21 to 8,457, but coming down from 19,028 in June'19. Still, this is the first increase since March'20. Condo/TH listings went from 29,247 i June'19 to 15,503 units June'21. Median time on market (entering the MLS to signed contract): from 46 to 12 days for SFH, and 63 to 31 days for Condos/THs. (The bump in summer 2020 shows how atypical that year was). Closed sales: +40.8% for single family homes, and +144% for condos and townhomes (June 2021 vs. June 2019). Median selling prices: +29.9% for SFH, and +22.6% for Condos/THs. In absolute numbers: SFH went from $365,000 to $500,000 selling price, which is $149,000 over the Florida median. Condos/TH went from $206,450 to $269,700. Noteworthy is also the rise of cash transactions. In June'21, 32.7% of all SFH in the MSA were bought all cash, up from 22.7% in June 2019. For Condos/THs, cash purchases went from 49.8% to 54.0%. Two price brackets are the main contributors: above $1m and under $250k.

Over $1m selling price, 56.7% of SFH as well as 70.1% of all Condos/THs are bought cash. That is quite common in our market; luxury sales are traditionally very often cash sales. At the lower end, 38.6% of SFH between $200,000 and $250,000 selling price, and 56.5% of SFH between $150,000 and $200,000 were bought cash in June. Those are not owner/users but investors who are storming this segment. The chief economist of the Florida Realtors® Association, Dr. Brad O'Connor, believes "all current signs point to us having reached the peak of the seller's market. That doesn't mean we're going to swing right back into a buyer's market, though. Remember, we were already in a seller's market for single-family homes before the pandemic. All this means is that market conditions for today's prospective buyers have [likely] finished worsening." To some extent, that will also depend on how mortgage interest rates develop. According to Freddie Mac, interest rates for a 30-year fixed-rate mortgage averaged 2.98% in June 2021, down from 3.16% in June 2019. In addition, I expect the Surfside collapse to put pressure on pricing for older condo units for a while, especially if regional or State laws are quickly enacted that go above and beyond the so-called 40year recertification requirement. Those are currently in place only Miami-Dade and Broward counties. But not for long – take my word for it. Questions, comments, corrections? I very much welcome your input! ___ *meaning: at the current selling pace, in X months all inventory would be depleted. In chapter 4 of my Guide to Florida Real Estate Transactions (the series started in April, in case you missed it) I will explain where the friendly real estate agent you are talking to on the phone, by Skype, Zoom or Signal might stand – or, to say it clearer: who he (or she) represents. Hopefully your interests.

Let's dive right in: In residential transactions (different rules apply to commercial and business transactions) agents can act only as a • transaction broker for the seller or the buyer or • seller's broker, representing the interests of the seller, • buyer's broker, representing the interests of the buyer, • non-representative, very similar to the broker model in many European countries. Agents often represent one party exclusively, typically the seller, though an agent may show a variety of other broker’s property listings to a buyer. If you are a buyer, you should insist that the agent you work with represents you and your interests. Working as a buyer's agent he is obligated to represent your interests and to find you the property best suited to your needs at the best possible price. A residential commission will typically be paid by the seller; this does not constitute a conflict of interest but is part of most listing contracts. 89% of US buyers claim a very good or even excellent experience in using a buyer's broker, and are very satisfied with the services and the results. Negotiating skills, experience and knowledge of the local market are the reasons most quoted for using an agent. (Survey of Recent Home Buyers ©2020 FAR). Buyer’s advantage: without additional cost he has a professional at his side representing his interests – which is not the case if a buyer contacts the selling broker or even the seller directly, for instance by calling a telephone-number on a “For Sale”-sign. If you are happy with your buyer’s broker, please remain loyal. Because the moment a seller or his real estate agent learn your name in any other way then through your agent, your agent will be excluded from the transaction. This means: he can’t represent you, can’t look out for your interests, can’t negotiate for you and will not receive any commission for all the services rendered to you. The result: deep frustration, the end of your business relationship, and for you having to start all over, this time without your agent’s support. It is a common misconception that the seller or a listing agent (the agent who markets the property) will pass on any commission savings when being contacted directly by a buyer who has the idea of cutting out one of the middle-men. Believe me: it does not happen. In addition, foregoing or worse, circumventing a buyer's agent, does not help the buyer in any way. In contrast, the buyer most likely pays more than he has to, since the seller's agent's obligation is not to save the buyer money, but to get the best deal and highest price for the seller. Tip: For your legal questions, please consult with a recommended Florida real estate attorney. Real estate brokers are neither qualified nor allowed to give you legal advice, and unauthorized practice of law is not taken lightly. ©2021 Tobias Kaiser ––– Above is an excerpt of my Guide to Florida Real Estate Transactions, which you can request for free. It is updated annually and available in English and in German. – Do you have any questions, corrections or comments? I would love to hear from you! Update: In 2008, Julio Robaina, then Republican state legislator in Florida, sponsored a law requiring condo associations to hire engineers or architects to submit reports every five years about how much it would cost to keep up with repairs.

The law lasted only two years before it was repealed in 2010, after Robaina left office. The legislator who sponsored the repeal, former state Rep. Gary Aubuchon, a Republican real estate broker and homebuilder. Robaina blamed the repeal on pushback from real estate lawyers and property managers, who he said claimed that the law was too burdensome for condo owners. The law might have very well prevented the Surfside tragedy. Robaina recently commented to NBC “If the [Surfside] owners would have had a reserve study, if the board was proactive and had funded its reserves, this never would have happened”. Q&A: After Surfside, What Should I Know About Condos? by Lois K. Solomon, 2 July 2021 Shaken by the recent disaster in Surfside, many condo owners wonder what they don’t know but should. A Q&A with specialists and attorneys provides some answers. FORT LAUDERDALE, Fla. – Many of us live in high-rise buildings in South Florida. And even if we don’t, we have to wonder about the condition of our apartments, condos and homes after the Surfside catastrophe. We asked construction specialists and attorneys about the questions we should all be asking about the condition of our living spaces and what kinds of updates they need as they deteriorate from heat, humidity, hurricanes and climate change. Question: What kinds of questions should condo owners, likely with little knowledge of building construction, be asking now? Answer: Ask about the age of your building, when the last inspection was and what kinds of repair work are planned in the near future, said Boca Raton attorney Peter Sachs, who is certified in condominium and planned development law. You will also want to know how much money is in the building’s reserve fund, and if and when an extra financial assessment is coming, he said. You have the right to inspect your building’s records, which would include finances and repair work. Florida law requires that condos maintain their official records for seven years. Question: Who’s at fault when there’s a serious structural problem in a building? Is it the architects, the builders, the engineers, the inspectors or city officials? Or all of the above? Answer: The architect, builder and engineer are all potentially culpable, as is the condo board if they do not act to fix the problem, Sachs said. He said the architect would be responsible if there is a serious design flaw, and the engineer if the calculations, supervision or drawings are deficient. The builder would be to blame if corners were cut on materials or if construction failed to comply with the building code. The builder may also be liable for the failings of the architect or engineer. The board, too, has obligations to residents, he said. “The board has a fiduciary duty to act in the best interests of the unit owners. If the board is negligent and fails to act, or unduly delays, it may be held liable,” Sachs said. But city officials are off the hook, according to Sachs. “The city officials are protected by the doctrine of sovereign immunity,” he said. “Barring criminal conduct (the building official accepted a bribe to look away from a potential problem), it is highly unlikely that a city or its employees would be held legally responsible.” Question: How often should structural engineers inspect high-rise buildings? Answer: Miami-Dade and Broward require inspections when a building turns 40, but there’s no similar mandate in the rest of the state, said Peter Sachs, a Boca Raton attorney certified in condominium and planned development law. The boards that supervise the buildings should take the initiative and conduct a thorough inspection at least every 10 years, and more often is better, said Yaniv Levi, president of Coast to Coast General Contractors in Hollywood. “It would behoove the association to do it yearly or bi-yearly,” he said. And he recommends the building get a new coat of paint, which also serves to weatherproof it, every seven to 10 years. Question: How quickly should buildings fix leaks and other water intrusions? Answer: Immediately, said Yaniv Levi, president of Coast to Coast General Contractors in Hollywood. “As soon as the leak is identified, they should find the source of the intrusion,” he said. “If you catch it early, it won’t develop into something major.” Question: How can I find out if my building was constructed under the highest safety codes? Answer: If it was built in 2002 or later, you should have the best building codes or close to it. If your building was constructed before 2002, it likely does not meet the highest standards unless it was damaged by a storm and had to be upgraded. After Hurricane Andrew in 1992 mowed down entire blocks of cheaply built houses, Florida adopted a statewide building code that has become a national model. So when Hurricane Wilma struck Fort Lauderdale 13 years later, new downtown buildings, such as the 42-story Las Olas River House, held up well. Older buildings constructed before the building code sustained severe damage. Question: What should owners do if they believe their board is ignoring a safety issue? Answer: You should ask to have the issue brought up at the next board meeting, said Hallandale Beach attorney Larry Tolchinsky. “Get it on the record that the board is ignoring the issue,” he said. “Thereafter, file a lawsuit against the board.” Boca Raton attorney Guy M. Shir agreed that you may need to take matters into your own hands. Call the local building or code enforcement department to report your concern, and put it in writing, Shir said. And if you can afford it, you may want to hire your own engineer. “In the end,” Shir said, “it’s (your) property, investment and life/safety issues.” Question: Should condos have rainy-day accounts to pay for property improvements? Answer: There’s often resistance from condo owners when a board of directors wants to add to the monthly maintenance fees, said West Palm Beach attorney Michael Gelfand, who is certified in condominium, planned development and real estate law. “The board is caught between irreconcilable goals: perfect safety, which is impossible, and the owners not wanting their assessments to go up,” he said. Condo associations are required by law to budget for reserve accounts for repairs of significant components, such as painting/waterproofing, roofs and paving, but frequently owners vote down these budgets as well as expensive structural work, Gelfand said. These repairs are often expensive. In emails released by the town of Surfside, an engineer said Champlain Towers South, the collapsed building, needed to spend about $9 million to repair cracked columns and crumbling concrete. The board took out a $12 million loan to do the work. The loan meant owners at Champlain Towers South were facing payments of anywhere from $80,000 for a one-bedroom unit to about $330,000 for a penthouse. Beyond the legally required reserve accounts, boards of directors take an assortment of approaches. Some have no reserves at all, while others have accounts dedicated to repairs needed every five to 10 years, said Mike Ryan, a Fort Lauderdale attorney and mayor of Sunrise. “Some condos cater to people with fixed incomes. It’s difficult for them to suddenly get hit with an assessment,” Ryan said. “It’s up to the board how they want to handle this. It’s wise for them to put aside money. If you defer too long, it becomes too costly.” The best strategy for the condo board is often to take the monthly maintenance fees and set aside some of that money for a rainy day fund, he said. This will lessen the financial impact on individual owners when a sudden major repair is needed and the board must ask each homeowner for money. Question: What if an owner can’t afford the assessment? Answer: “It’s like a lifeboat,” said West Palm Beach attorney Michael Gelfand, who is certified in condominium, real estate and planned development law. “If you can’t pull your weight, you’re off.” The association may foreclose on your unit. Otherwise, their accounts will run a deficit and they won’t be able to pay the bills. Sometimes the association will borrow money from a bank to pay for these large expenditures, Hallandale Beach attorney Larry Tolchinsky said. “For those unit owners that can’t afford to pay, the association will likely spread the payments over time,” he said. “Up to 10 years in some cases.” Question: Will prices of semi-attached condos or low-rise units increase significantly? “We moved from Massachusetts to the Lotus development in West Boca in June 2020. Since we made our deposit in March 2019, the market value of our home is up 86%, due to constant price increases. I’m wondering if enough owners will now start selling their high-rise condo units [so] that the values of these units will drop significantly. At the same time, will the prices of semi-attached condos, or low-rise units increase significantly? I can see a number of owners moving to what they will now perceive as ‘safer’ housing. I can also see a number of snowbirds deciding to sell before prices drop, then renting for the season or buying a winter home in low-rise or garden-style units.” – Arthur Missan Answer: Ken Johnson, a real estate economist at Florida Atlantic University, said he does not anticipate significant effects on prices because of the Surfside collapse. He said buyers likely will perceive the collapse as a freak accident that’s unlikely to be repeated. “I expect to see an increase in the demand for satisfactory property inspections contingent upon closing,” he said. “However, I do not see any price impact due to this horrible tragedy. Most know that this sort of thing is unlikely to ever happen again. As for a moving strategy, I don’t really see one with the average cost of a move, all things considered, being between 10% and 20% of selling price.” Question: In terms of safety, is it better to live on a high floor or a low floor? Answer: “In my personal opinion, there are risks in both cases,” Hallandale Beach attorney Larry Tolchinsky said. “Living on the ground floor can have flooding issues. Perhaps issues with crime. Higher floors take longer to escape from the building and they have wind issues.” Question: Is it going to be harder to find concrete repair firms now that everyone is thinking about these questions? Answer: “Perhaps, but my belief is the collapse was more complicated than just issues related to concrete repair,” Hallandale Beach attorney Larry Tolchinsky said. “Certainly, the cost of having a firm perform these repairs is going to skyrocket. This is based on the level of data and certifications that will likely be needed to be provided to boards and governmental agencies to perform this work. Also, the high demand for building materials and the lack of skilled workers given the tight labor market will make it harder to find concrete repair firms.” ©2021 South Florida Sun-Sentinel.com via FloridaRealtors.org. ___ Please contact me if you have any questions or would like further information. I will be happy to assist in any way I can. “It Caught My Eye” is a series of posts about chance encounters with interesting architecture or design, published at irregular intervals. Often I accidentally stumble across something that catches my eye, while at other times I drive past an interesting building repeatedly and each time think “hmmm...”

Such is the case with this defunct modernist gas station at 2366 Las Olas Blvd. in Fort Lauderdale, Florida. Built in 1957, four design elements I find noteworthy and lovely: • the dry-stacked stone walls – on a gas station! • the inward-inclined windows to reduce solar gain and glare, very rare these days, • the interior downlight cans (you have to look closely in the pic), running parallel to the windows, and • the angled canopy, complete with a cutout for the brand post. Lovely – but likely not for long: the station has been closed for at least two years, and being located on very valuable land, it is only a question of time when a Phase 2 environmental audit will be completed and the site usage will be changed. Sad for the structure, but a service station in this location is probably not the highest and best use of the site. If you happen to be near East Las Olas Blvd. in Fort Lauderdale just west of the Intracoastal: check it out! Germany, similar in size to the state of Montana, has approximately 83 million people, so open space is at a premium. At cemeteries, it is customary that you don’t buy a burial plot and it’s yours for eternity - you purchase in essence a land lease for 30 or 50 years, reverting back to the cemetery after that. In North Rhine-Westphalia for the funeral of a family member in 2018, I encountered an alternative building use I had never seen before: the conversion of a church into a Grabeskirche (burial church) for urns. The church in question, St. Josef in the small town of Viersen, located on the lower Rhine near the Dutch border, was designed by architect Josef Kleesattel and, in neo-gothical style, is typical for church buildings in this part of Germany. It was dedicated in 1891 and partially converted to a Columbarium in 2012, aided by the fact that the catholic church allows cremation of its members again since 1963, something it had forbidden since 765. The space adaptation of the building is convincing and harmonious: about 2/3 of the nave has been converted into a Columbarium with walls for urns. The altar has been left intact, and there is enough space to hold funeral services in the sanctuary, as well as community events and frequent concerts. All pathways are ADA- (equiv.) compliant, and besides a priest there is a competent team on site to aide relatives in planning and execution of funeral ceremonies. The current configuration offers 1,638 niches for urns, of which over 800 were sold when I spoke with a church team member during my visit. A two-year remodeling plan, designed by architect Ulrich Hahn of Hahn Helten architects https://www.hahn-helten.de in Aachen, will create another 1,000 spaces. Astonishing for anyone who has encountered catholic conservatism: the burial plots are available to deceased of any religion or if the person had even formally left the church. Bravo! Please leave your comments and questions below – I’m very curious to hear your opinion. Krypta photo ©Uwe Rieder, all other photos ©tckaiser

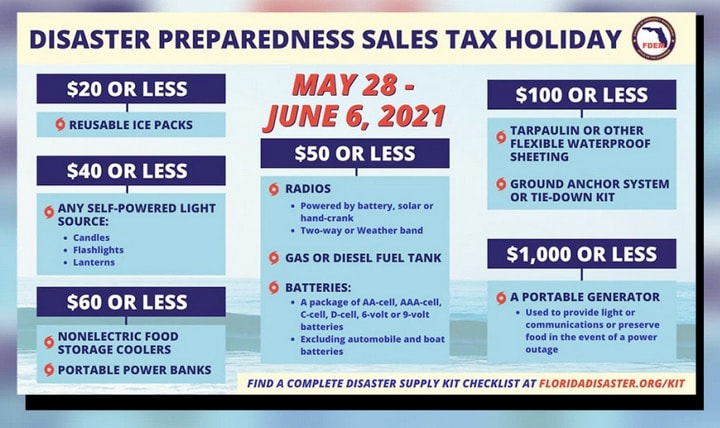

It’s that time of the year... No, not Christmas! Not yet at least. Haven’t you been outside lately? It’s Hurricane Season, starting 1st of June, luckily coinciding with a Florida Tax Holiday, starting this Friday 28 May, and running until Sunday a week later, 6 June. (Non-Floridians: during a Tax Holiday, which normally happens shortly before the new school year starts, there is no sales tax levied on exempt items; typically 6.0 or 7.0 percent.) The cherry: quite a few items for your Hurricane Box – you do have one, yes? – are included in the sales-tax-exemption. Just refer to this spiffy handy guide: And while you’re busy surfing the net, also download the supply kit checklist from www.floridaDisaster.org/kit.

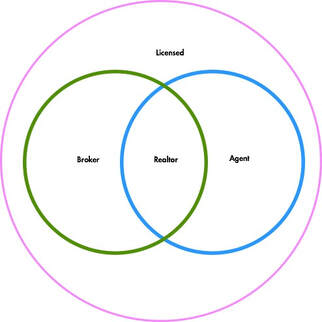

NOAA (National Oceanic and Atmospheric Administration) is predicting an "above-normal" 2021 Atlantic hurricane season which runs through 30 November, so do stock up now. Now, if you’d rather quickly sell your house before the season starts: Who is the fairest Realtor of all? :-D That's correct!  Brokers, Agents, Realtors® Brokers, Agents, Realtors® Part 3: AGENTS, BROKERS and REALTORS® - What's the Difference? In order to broker properties or businesses in any US state, one has to be properly licensed in that state, either as a real estate broker or a real estate agent. Agents have to pass one, brokers two state exams. In Florida, both licenses must be renewed every two years through a short exam. An agent always work in a broker's office under his/her supervision. A broker may work for another broker or self-employed. All real estate professions in Florida are regulated and supervised by two state authorities. OTHER QUALIFICATIONS When you consider buying or selling US property - residential property or commercial investment - in practically all situations you should be using an agent or broker to represent your interests in the transaction. He/she should:

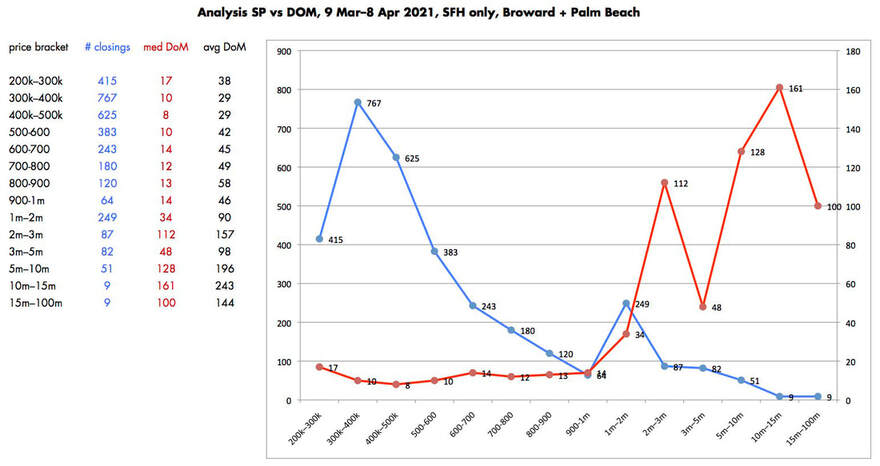

An agent (following for agent or broker) may call himself a Realtor® only if he (following for he or she) belongs to the local Board of Realtors®, a voluntary professional association with strict business and ethical guidelines that often exceed state law. As the graphic on the left hopefully clarifies: all brokers and agents are licensed, but only some licensees are Realtors©. Many commercial practitioners for example don't need a Board membership or benefit from one, so they don't belong. For residential agents, membership in the Board of Realtors® is the only way for full access with selling and listing privileges in a proprietary regional property database called Multiple Listing Service or MLS. This database may contain 95-98 percent of all regional residential properties for sale, as well as some commercial properties also offered by MLS participants. The Southeast-Florida-MLS for example, consisting of several Boards and their MLS databases, and reaching from Homestead to Fort Pierce, connects over 85,000 agents with over 80,000 properties and businesses for sale. As a result, buyers can (and should!) avoid agent-shopping and instead concentrate on working with one agent who can offer and sell any property shown in the MLS, not only the ones offered by his own firm. More on loyalty further below. HOW TO PICK A GOOD AGENT The sheer number of Realtors in South Florida can be overwhelming, and it may seem everyone you know has a license and wants your business. But your choice of an agent should be guided by other criteria than being a neighbor or golf buddy: by the level of competence in his/her specialty, by how well you communicate, ideally by past client references, and certainly by a feeling of trust and confidence. You don’t have to become best friends for life or be smitten at first sight, but if you don't like an agent, for the sake of a harmonious transaction it sure is better to chose another one to work with and remain loyal to your choice. You expect commitment from your agent to find the best deal and prevent you from making mistakes, and your agent in return has the right to expect commitment and loyalty from you, the client.  Commercial Realtor (red) and CIPS logos Commercial Realtor (red) and CIPS logos Important is that your agent is experienced in like transactions and knows what you are expecting. He should explain the terminology to you in plain language and guide you through the sequence of a deal. If there is an international or a commercial aspect, you will only be served well by an agent who is certified as a CIPS (Certified International Property Specialist) or by someone experienced in commercial transactions. E.g., a residential condo expert dabbling in commercial real estate is a recipe for a disaster, and the client is paying the price. Any questions on this chapter? Want to read the whole guide in one session? Then please contact Tobias. He will be delighted to hear from you. ____________ ©Tobias Kaiser. Use or reproduction only with written permission from the author. Today I want to share with you a look at the fastest- and slowest-selling price brackets in South East Florida. In my office's team meetings as well as in discussions with colleagues and consumers, this market statistic always pops up, mostly as an impression or unfounded opinion ("my neighbor heard of someone who's friend's house sold for $29m in 2 days.") Funny how stories take on a life of their own, isn't it? If you have hard data, you may find out the asking price over the last three years was $26m, and only when it was cut in about half to $14.5m by the bank, it sold in less then two months. Such is our world where everyone is a real estate expert. Perhaps I should advise my dentist with the profound knowledge I learned on the web about dentistry? Now let's have a look: Table and chart are pretty much self-explanatory. I created this analysis mid-April, based on sold single family homes in Broward and Palm Beach counties, Florida. I chose the most common selling price brackets for our market, while DoM refers to Days on Market or the time period from hitting the market to going into contract. Blue is the number of closings in the previous 30 days, while red shows the median DoM.

The curve visualises nicely how fast things move: rapidly from $200k to $1m; from $1m to $2m takes a bit longer, and over $2m it takes between six weeks and five months – in median days. Averages are considerably higher, and even those are under-reported because often enough a property gets taken off the market for a week or two, then relisted with a fresh MLS number so it doesn't appear "stale". Silly tactic, but not uncommon for expensive and/or overpriced homes. What are your observation or thoughts?  When you go on a vacation or an out-of-town business trip or, your primary concern will always be the safety and security of the house you're leaving for a longer time than usual. Sure, you may have home insurance coverage, but that doesn't mean it will make losing stuff to a fire or burglars hurt any less. You will also have to go through the hassle of filing a claim, which can get a bit tricky in the middle of a global pandemic. If you're going away for an extended period, make sure you do the following to protect your home: Don't Let The World Know No One's Home We live in a world dominated by social media, the perfect place to make people green with envy by posting in real-time photos and videos of your vacation or business trip to another city, state, or country. Unfortunately, social media is also where burglars can scout for houses to hit, and your posts will definitely help them out in that regard. It's OK to share proof of out-of-town trips, but it's best that you wait until you're back home before dumping all your videos and pics on social media. If you can't help yourself, you should at least make sure your sharing setting is set to private. Ask For A Neighborly Favor Do you have neighbors you can trust? If so, then try asking them if they can at least keep an eye on your home and call 911 if they notice anything suspicious happening inside or outside your property. If you trust a neighbor enough, you can also leave them an extra key so they can check your home from time to time. In case something unfortunate does happen, giving your neighbor your contact details would allow them to contact you right away. Trick Would-be Burglars Into Thinking Someone's Home Few criminals will not hesitate if they think a target house is actually occupied. One effective way you can make people think someone home is by setting timers on your lights, so they turn on at certain times of the day and night, ideally at varying times – there are plug-in timers for instance with dusk-activation. When you leave, take a cab or use a ride-hailing service to take you to the airport or train station so you can leave your car parked on your driveway and give out the impression that its owner is home. Alternatively, ask a neighbor to park his/her car in your driveway. Unkempt lawns could signal to thieves that no one is cutting the grass, so keep your landscaping appointments even when you're away. Unplug Appliances Power surges could occur when no one's home and damage your appliances. You can avoid that by unplugging your TV, computer, and other electronics. As for your refrigerator, whether to unplug it or not will depend on how long you're going to be away. If you are gone for only a week, it might be more practical just to leave your fridge plugged in and make sure it's equipped with a surge protector. If your trip will keep you away for a month or longer, unplug your fridge before you go. Consume or give away its perishable contents to neighbors or friends so they won't go to waste. Shut Off The Main Water Valve Few things can thoroughly ruin your homecoming from an extended trip than your furniture, appliances, and other belongings floating on a foot or so of water, courtesy of a pipe that burst while you were gone. You can prevent that from ever happening if you shut off the water, which you can easily do if you know the location of the main valve. [Note: If you have a sprinkler system for your garden, obviously do not shut the water off; your plants and lawn will thank you - tck] Secure Your Valuables It's just too much of a risk if you leave jewelry, cash, and other valuables lying around the house. If you have a safe, make sure you lock everything in there, including vital documents and hard drives that contain crucial files and information. Better yet, go to your bank and put them all in a safe deposit box before you leave. These are just some of the many ways you can protect your home when you go on a long trip, but they should be good enough places to start. ______________ Guest post courtesy of Rachael Harper, Content Marketing Strategist of Bennett & Porter, a wealth management and insurance firm based in Scottsdale, Arizona. When not writing, she makes use of her time reading books and playing bowling with her family and friends. INTRO You might be aware of the fact that real estate purchases and sales in the United States differ substantially from many other countries, and even from one US state to another. In 1996, after a few years in business as a real estate broker, I put together a little flyer for my foreign buyers and sellers, explaining some of those differences. Based on 30 years experience in the market as an independent Florida broker and consultant, the flyer has grown into a 16-page PDF, updated annually. Focused on laws and customs in the State of Florida, property transactions in other states will differ, but the brochure should still afford non-professionals a general overview on the key transactional elements and sequence of a property purchase or sale in the US. I am delighted about the opportunity to share some of my knowledge, so over the next few months I will post chapter by chapter (excerpts or complete chapters, depending on length and detail) here on this blog. All information comes from reliable sources and/or my own experience, however it is not warranted and – very important – can never replace professional advice. With any questions you may have (and I am certain you will) I cordially invite you to contact me any time. Part 1: TYPES OF PROPERTY

Considering a real estate purchase, the first question should be: what type of property fits my goals? One generally differentiates between:

Among those, Residential refers only to:

Commercial includes, among others:

Business Opportunities very often refer only to the business, not including the real estate it inhabits, such as:

A good broker or agent (see below) will assist you in defining your real estate investment goals and advise you in selecting a matching property. Part 2: STEP BY STEP - THE TRANSACTION SEQUENCE Real estate acquisitions in the US typically follow a specific structure: Broker selection | Definition of transaction goal | Property definition | Property search | Property selection | Contract | Inspections/due diligence | Closing | Improvements if necessary The sequence may vary, but in general it will be altered only very little, independent of property or state. In following posts you will read about each of those steps in more detail. You may have read that, among other areas in the US, the South Florida residential market experienced a massive price increase, coupled with a major inventory decrease, in Q3 and Q4 last year.

It's true. Median selling prices for all single family homes increased between 13.0 and 17.8 percent each and every month from July until December, compared to the previous year. That translates into a blended 14.8 percent selling price increase for the second half of 2020 vs. 2019. At the same time, inventory for sale practically halved, from typically 18,000 to 19,000 homes to just over 10,000 – and it's further decreasing, today to just under 9,000 homes. That is not sane, but it's a not a bubble either. Take a deep breath: the modern home market shows even higher numbers, unfortunate from a buyer's and a Realtor's perspective: median selling prices in Q4 2020 versus Q4 2019 rose by 70.0 percent, while time on market dropped substantially. That means: weak purchase offers vaporize into this air, and procrastinating buyers won’t even get a shot. For the January stats, I first thought I had made a mistake in my analysis (there is no modern home data broken out in the statistics, so I run my own modern home analysis every month): the median selling price of all modern homes I tracked which sold in January was virtually identical to the asking price. I don't recall that happening any time after the 2008 housing crash. Overall, 17% of all single-family homes across all price levels closing in January 2021 sold above list price, Miami proper and Miami-Dade County showing the highest demand. Can you just sit it out? Likely not the best idea, unless you have lots of time and deep pockets. The National Association of Realtors helpfully states that 2021 should be a bit saner: "Although the pace will slow from the late 2020’s frenzy, fast sales will remain the norm." "Buyers who prepare by honing in on... home characteristics that are must-haves vs. nice-to-haves and lining up financing including a pre-approval will have an edge... as sellers will be in a good position in 2021." (Forbes, Jan 2021) Forecasts for our region, the Miami-Fort Lauderdale-West Palm Beach MSA, predict a sales increase of 3.7%, and a median selling price increase of 7.1% (2021 NAR Housing Market Predictions and Forecast). Translated: we are in a strong seller's market, most likely throughout all of 2021 and possibly into next year. If you do plan to buy a Florida residence, all data indicate it is advisable to act rather sooner than later – and if you do find a home you like, don't wait but go for it. If you are on the other side of the fence, a Florida seller considering putting your modern house on the market: please contact me so we can lay out the best options for you. Any questions or comments? I'd love to hear from you! The travel restrictions prohibiting US entry of most non-residents, except close relatives of US citizens, airline crews, medical professionals etc., did not expire as originally planned on 31 December 2020, and have not been lifted by the new administration either.

There are some exceptions added, namely for investors, but in essence most travelers from the Schengen area and quite a few other countries still can not travel to the US. Furthermore, a client told me that at least EU health insurance providers will not offer any health care coverage for any unnecessary – read: anything touristy – trip into a high-risk area such as the US. For more details, please visit the CD website https://www.cdc.gov/coronavirus/2019-ncov/travelers/from-other-countries.html |

AuthorTobias Kaiser works as an independent real estate broker and consultant in Florida since 1990. Always putting his clients' interest first, he specialises in modern Florida homes and architecture, as well as net leased investments. Archives

April 2024

|

- Home

- Modern Homes for sale

- Selling a Home

- Inquiries

- Why Tobias Kaiser?

- Contact

- "Modernist Angle" Blog

- Services we offer

- South Florida City Profiles

- Intro to Modernism

- Modern Styles explained

- Elements of Modern Architecture

- Preservation

- Real Estate FAQ

- Deutsche Seite >

- Net-Leased Investments >

- About Tobias Kaiser

|

|

KAISER ASSOC, INC • LIC FLORIDA REAL ESTATE BROKERS & CONSULTANTS

dba MODERN FLORIDA HOMES • 370 CAMINO GARDENS BLVD • BOCA RATON, FLORIDA 33432, USA TOBIAS KAISER, MSc, CIPS • REALTOR/BROKER • MODERN ARCHITECTURE SPECIALIST MEMBER NAR, RCA, DOCOMOMO, NCMH • EMAIL • (+1) 954 834 3088 ZERO DISCRIMINATION: Kaiser Assoc. and its agents will not discriminate against any person because of race, color, religion, sex, handicap, familial status or national origin in the sale or rental of housing or lots, in advertising the same, in the financing of housing in the provision of real estate brokerage services, in the appraisal of housing, or engage in blockbusting. Kaiser Assoc. strictly adheres to the National Association of Realtors© Code of Ethics and Standards of Practice in accordance with Federal Fair Housing Laws. "SILENCE IS CONSENT": As a multi-cultural office neither do we silently consent to nor do we tolerate any type of discrimination, racism or prejudice. We strive to listen and learn what needs to be done to implement permanent change. Site design + contents ©Tobias Kaiser 2024. PUBLICATION, USE OR REPRODUCTION incl. parts ONLY WITH WRITTEN PERMISSION. |

RSS Feed

RSS Feed