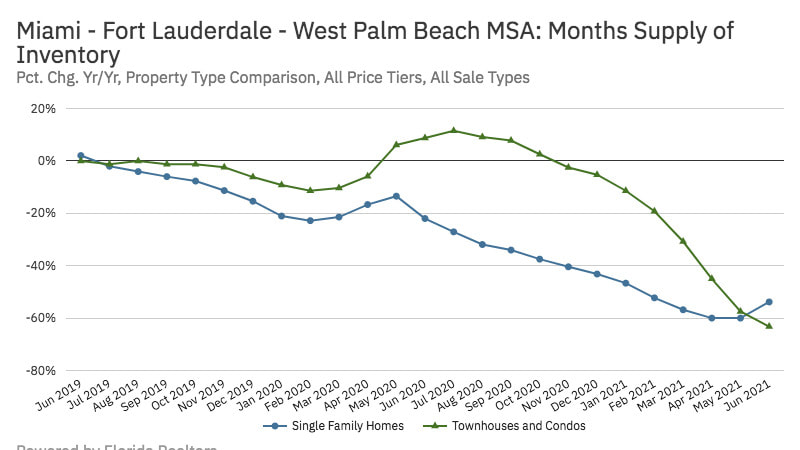

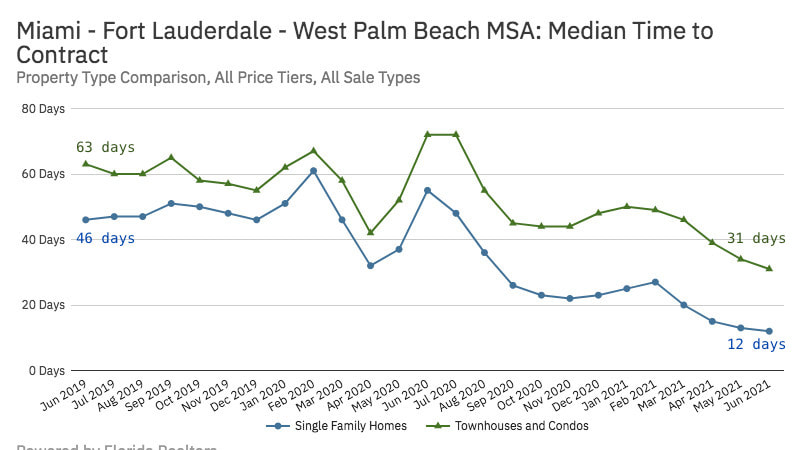

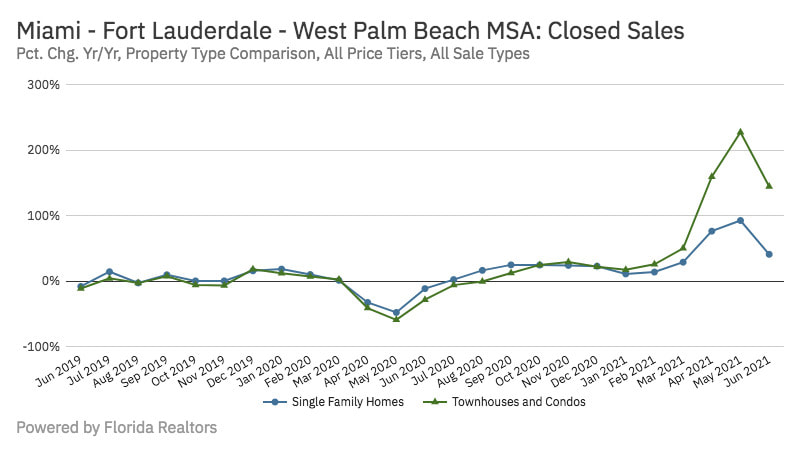

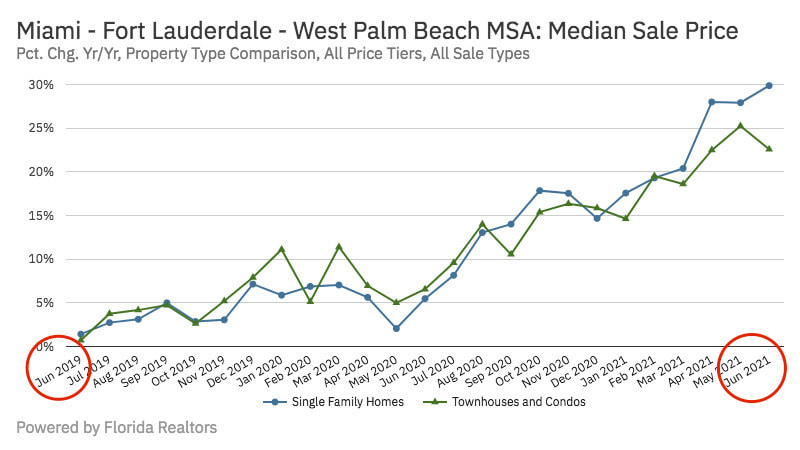

Overall, the main trend of the regional residential market – more closed sales and higher median prices – continues, but now with more new listings and a slight easing of the buyers-to-sellers ratio. As we enter the second half of 2021, the first change indicators for somewhat calmer times are appearing. Because Florida started its lock down last year on April 1st, I compare statistics not with June 2020 but June 2019, the last "normal" pre-pandemic period. Mid- to late 2020, as people adapted into a rhythm of life with the pandemic, the recovering regional housing market was in most aspects a market on steroids, making up for the lost spring and early summer buying peak, and thus considered atypical. Geographically, I am analysing the Miami-Fort Lauderdale-West Palm Beach MSA (Metropolitan Statistical Area, a standard US urban and suburban geo-definition) - which consists of the three counties Palm Beach, Broward and Miami-Dade, locally also referred to as the TriCounty area. Inventory in months*, where 4-6 months is generally considered a balanced housing market: Dropping from 5 mos for SFH to 1.8 mos, and from 8 to 3.2 mos for Condos/TH. Active inventory: For SFH increasing from May'21 to June'21 to 8,457, but coming down from 19,028 in June'19. Still, this is the first increase since March'20. Condo/TH listings went from 29,247 i June'19 to 15,503 units June'21. Median time on market (entering the MLS to signed contract): from 46 to 12 days for SFH, and 63 to 31 days for Condos/THs. (The bump in summer 2020 shows how atypical that year was). Closed sales: +40.8% for single family homes, and +144% for condos and townhomes (June 2021 vs. June 2019). Median selling prices: +29.9% for SFH, and +22.6% for Condos/THs. In absolute numbers: SFH went from $365,000 to $500,000 selling price, which is $149,000 over the Florida median. Condos/TH went from $206,450 to $269,700. Noteworthy is also the rise of cash transactions. In June'21, 32.7% of all SFH in the MSA were bought all cash, up from 22.7% in June 2019. For Condos/THs, cash purchases went from 49.8% to 54.0%. Two price brackets are the main contributors: above $1m and under $250k.

Over $1m selling price, 56.7% of SFH as well as 70.1% of all Condos/THs are bought cash. That is quite common in our market; luxury sales are traditionally very often cash sales. At the lower end, 38.6% of SFH between $200,000 and $250,000 selling price, and 56.5% of SFH between $150,000 and $200,000 were bought cash in June. Those are not owner/users but investors who are storming this segment. The chief economist of the Florida Realtors® Association, Dr. Brad O'Connor, believes "all current signs point to us having reached the peak of the seller's market. That doesn't mean we're going to swing right back into a buyer's market, though. Remember, we were already in a seller's market for single-family homes before the pandemic. All this means is that market conditions for today's prospective buyers have [likely] finished worsening." To some extent, that will also depend on how mortgage interest rates develop. According to Freddie Mac, interest rates for a 30-year fixed-rate mortgage averaged 2.98% in June 2021, down from 3.16% in June 2019. In addition, I expect the Surfside collapse to put pressure on pricing for older condo units for a while, especially if regional or State laws are quickly enacted that go above and beyond the so-called 40year recertification requirement. Those are currently in place only Miami-Dade and Broward counties. But not for long – take my word for it. Questions, comments, corrections? I very much welcome your input! ___ *meaning: at the current selling pace, in X months all inventory would be depleted.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorTobias Kaiser works as an independent real estate broker and consultant in Florida since 1990. Always putting his clients' interest first, he specialises in modern Florida homes and architecture, as well as net leased investments. Archives

April 2024

|

- Home

- Modern Homes for sale

- Selling a Home

- Inquiries

- Why Tobias Kaiser?

- Contact

- "Modernist Angle" Blog

- Services we offer

- South Florida City Profiles

- Intro to Modernism

- Modern Styles explained

- Elements of Modern Architecture

- Preservation

- Real Estate FAQ

- Deutsche Seite >

- Net-Leased Investments >

- About Tobias Kaiser

|

|

KAISER ASSOC, INC • LIC FLORIDA REAL ESTATE BROKERS & CONSULTANTS

dba MODERN FLORIDA HOMES • 370 CAMINO GARDENS BLVD • BOCA RATON, FLORIDA 33432, USA TOBIAS KAISER, MSc, CIPS • REALTOR/BROKER • MODERN ARCHITECTURE SPECIALIST MEMBER NAR, RCA, DOCOMOMO, NCMH • EMAIL • (+1) 954 834 3088 ZERO DISCRIMINATION: Kaiser Assoc. and its agents will not discriminate against any person because of race, color, religion, sex, handicap, familial status or national origin in the sale or rental of housing or lots, in advertising the same, in the financing of housing in the provision of real estate brokerage services, in the appraisal of housing, or engage in blockbusting. Kaiser Assoc. strictly adheres to the National Association of Realtors© Code of Ethics and Standards of Practice in accordance with Federal Fair Housing Laws. "SILENCE IS CONSENT": As a multi-cultural office neither do we silently consent to nor do we tolerate any type of discrimination, racism or prejudice. We strive to listen and learn what needs to be done to implement permanent change. Site design + contents ©Tobias Kaiser 2024. PUBLICATION, USE OR REPRODUCTION incl. parts ONLY WITH WRITTEN PERMISSION. |

RSS Feed

RSS Feed