|

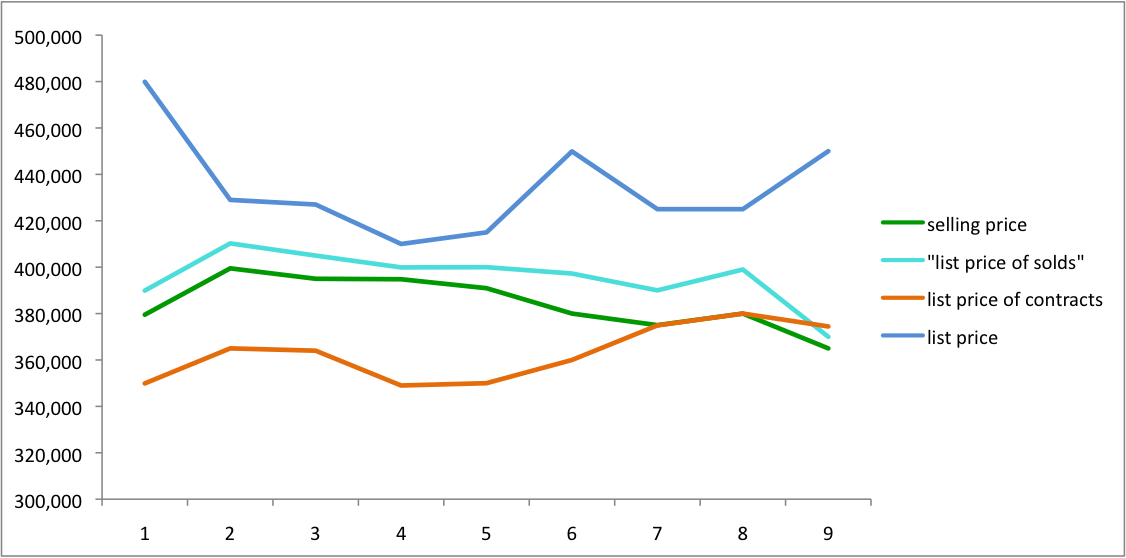

Is the Florida real estate market going sideways? –Photo ©Resnick That must be one of the most-asked question posed to real estate brokers and agents these days. And while “experts” are tripping over each other to produce an “outlook” or a “forecast”, hard numbers are hard to come by. Even trade publications contradict each other with headlines ranging from “market is going up” to “market is frozen”, and local Boards of realtors are not much help either. During the Lehman-Brothers-crisis, when during the giddy way up and the vertigo-inducing free-fall to the bottom, while everyone screamed “NOW is a great time to buy a home!!!”, I started to run my own market statistics. As real estate brokers in the US, we have incredible transparency of the residential market at our hands, so sometime in February this year I started to analyse several sets of numbers weekly. I was interested not only in properties on the market (Actives), but even more so properties going into contract (Pendings), and properties that closed. I split those three sets into two, one for single family homes (SFH) and for townhomes and condos (TH/C), all located in the Tri-County area, Palm Beach - Broward - Miami-Dade. And for those properties, I analysed the median prices – in our market, the delta between highest and lowest prices is way to large to work for averaging. Those median prices are for: • Actives • Pendings • List prices of Sold properties and finally • Selling prices of Sold properties. What fun. Seriously, not only in a geeky way, but also because at some point a pattern becomes visible. Let me explain: The first Covid-19 case in the US became known on 21 January, 2020, in Washington State. The first infection in Florida was on or around 1 March, 2020. And pronto, from early March on, the number of Single Family Homes (SFH, which what I analyse here) in the Tri-County area of SE Florida – Palm Beach, Broward and Miami-Dade counties – dropped a bit every week until mid-April. Then they started to rise again. SFH: median List price of Actives, List price of Pending Contracts, List Price of Solds and Selling Price of Solds; TriCounty; 1st week Mar - 2nd week May'20

Asking prices for SFH mirrored the number of “Actives” and they are now, third week in May, pointing up again; see the blue line in the chart above. If I had only absorbed more of Edward Tufte’s outstanding “The Visual Display of Quantative Information”, I would create better graphs. But even owning that tome for over 15 years hasn’t made me any smarter. So please endure my mediocre Excel charts. For future sales, the major indicator is the number of pending contracts. And from the first week in March to the second week in May, Pendings mirrored the fluctuation of Actives. But when you examine the asking prices of Pendings, properties in contract – remember, they haven’t closed yet, so there is no sales price – there is quite a gap between the asking prices of Actives versus the asking prices of Pendings; see if the orange line. How to read this? A lot of properties are for sale at a median price of $450,000, but those with contracts have only a median of $374,450 – a whopping 17 percent less. Confirming the issue: while the list price of Pendings is flattening out in the last two weeks, “aspirational pricing” by sellers makes the median price of all Actives – the blue line – go up. Why? Because a vast number of sellers think they can ask more. Which is not true. When I look at the number of closed sales, I see a substantial drop from early March to the second week in May: minus 52 percent. That is not only substantial but also an interesting indicator, as the typical time-frame between going into contract or pending and actually closing is about four to six weeks locally. Now consider the asking prices of those properties which actually sold: median $370,000. Asking prices for all homes right now: $450,000, $80,000 or 21 percent more. Does that make you believe the majority of current sellers have their finger on the market pulse? From a peak around late March/early February, asking prices of properties that sold and their actual selling prices have dropped. That is in line with the 4 - 6 weeks delay that I had mentioned above. In my dorky chart, you can see how the gap is widening between the asking prices of Solds versus overall asking prices, and also of selling prices. That makes it, as an Irish friend says, triple crystal clear: a majority of sellers in our local market is currently quite delusional about what they can get versus what buyers are willing to pay. Consumer confidence is low, and now that states are opening up, people may feel like splurging a little – on a soothing dinner, a nice bottle of wine or a new pair of jeans. But a home purchase falls into a different category of spending and needs a totally different level of confidence in the buyer’s financial future. Where do we go from here? We will probably see a flat at best or even slumping housing market in the area for quite a while. Market drivers will be cash buyers, investors with thick fluffy capital blankets and those who need to move, and of course sellers who need to sell. Anyone who can wait may very well sit on the fence and watch the game until the third or fourth quarter, possibly even into 2021. Clients told me yesterday: lenders and mortgage brokers prepared them that lending rules change day by day; what was working three days ago isn’t anymore now. That certainly doesn't make a house purchase easier or more pleasurable, and will have an additional dampening effect. My advice to sellers: be realistic and trust a good agent, because – I know I’ll get flak for this – your property is likely not worth what you think it is. That is a tough nut to swallow, but as a seller you have to decide if you want to go poking around a bit, or seriously sell your property. My advice to buyers: cash is king, and in lieu of that an ironclad loan pre-approval paired with a good strong offer. But don’t you go out now and insult sellers, you hear? In the words of Edward Murrow: “Good Night, and Good Luck.” -- Any questions? I’m always available and happy to hear from you. – I’ll update data and charts in about a month, so please keep tuned.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorTobias Kaiser works as an independent real estate broker and consultant in Florida since 1990. Always putting his clients' interest first, he specialises in modern Florida homes and architecture, as well as net leased investments. Archives

April 2024

|

- Home

- Modern Homes for sale

- Selling a Home

- Inquiries

- Why Tobias Kaiser?

- Contact

- "Modernist Angle" Blog

- Services we offer

- South Florida City Profiles

- Intro to Modernism

- Modern Styles explained

- Elements of Modern Architecture

- Preservation

- Real Estate FAQ

- Deutsche Seite >

- Net-Leased Investments >

- About Tobias Kaiser

|

|

KAISER ASSOC, INC • LIC FLORIDA REAL ESTATE BROKERS & CONSULTANTS

dba MODERN FLORIDA HOMES • 370 CAMINO GARDENS BLVD • BOCA RATON, FLORIDA 33432, USA TOBIAS KAISER, MSc, CIPS • REALTOR/BROKER • MODERN ARCHITECTURE SPECIALIST MEMBER NAR, RCA, DOCOMOMO, NCMH • EMAIL • (+1) 954 834 3088 ZERO DISCRIMINATION: Kaiser Assoc. and its agents will not discriminate against any person because of race, color, religion, sex, handicap, familial status or national origin in the sale or rental of housing or lots, in advertising the same, in the financing of housing in the provision of real estate brokerage services, in the appraisal of housing, or engage in blockbusting. Kaiser Assoc. strictly adheres to the National Association of Realtors© Code of Ethics and Standards of Practice in accordance with Federal Fair Housing Laws. "SILENCE IS CONSENT": As a multi-cultural office neither do we silently consent to nor do we tolerate any type of discrimination, racism or prejudice. We strive to listen and learn what needs to be done to implement permanent change. Site design + contents ©Tobias Kaiser 2024. PUBLICATION, USE OR REPRODUCTION incl. parts ONLY WITH WRITTEN PERMISSION. |

RSS Feed

RSS Feed