|

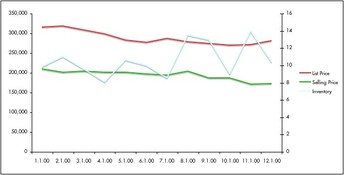

THE RESIDENTIAL MARKET OVERALL The February market for houses in the Southeast Florida Tri-County area, encompassing Miami-Dade, Broward and Palm Beach, suddenly turned extremely active. Fewer homes came on the market, and while the numbers show a very slight increase in median list prices, the number of sold homes is up drastically, with largely unchanged but rather soft selling prices. Interesting also: the very volatile inventory curve over the last six months. Pent up demand or investors? The reasons for the sudden activity are not quite clear to me or many of my colleagues. One bird doesn't make spring though; it remains to be seen how this will develop over summer. Certainly Florida unemployment hasn't changed much, which is the biggest factor in property purchase decisions. The numbers:

(SFH data Feb 2010 to Feb 2011. Red: median list price, green: median selling price, blue: inventory in months. Data source: SEF-MLS) THE MODERN HOME MARKET In the meantime, in the modern market available inventory as well as prices of observed sales are further sinking, while prices per sf went up last month. The lower end of the market – approx. under $1.5m, really bad under $800k – still looks plundered like a supermarket shelf just before a storm. Good homes generate a lot of interest from multiple buyers and go under contract fast, so it's not the time to lean back and relax if an interesting home does become available. ___ As always, your comments and questions are welcome!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorTobias Kaiser works as an independent real estate broker and consultant in Florida since 1990. Always putting his clients' interest first, he specialises in modern Florida homes and architecture, as well as net leased investments. Archives

April 2024

|

- Home

- Modern Homes for sale

- Selling a Home

- Inquiries

- Why Tobias Kaiser?

- Contact

- "Modernist Angle" Blog

- Services we offer

- South Florida City Profiles

- Intro to Modernism

- Modern Styles explained

- Elements of Modern Architecture

- Preservation

- Real Estate FAQ

- Deutsche Seite >

- Net-Leased Investments >

- About Tobias Kaiser

|

|

KAISER ASSOC, INC • LIC FLORIDA REAL ESTATE BROKERS & CONSULTANTS

dba MODERN FLORIDA HOMES • 370 CAMINO GARDENS BLVD • BOCA RATON, FLORIDA 33432, USA TOBIAS KAISER, MSc, CIPS • REALTOR/BROKER • MODERN ARCHITECTURE SPECIALIST MEMBER NAR, RCA, DOCOMOMO, NCMH • EMAIL • (+1) 954 834 3088 ZERO DISCRIMINATION: Kaiser Assoc. and its agents will not discriminate against any person because of race, color, religion, sex, handicap, familial status or national origin in the sale or rental of housing or lots, in advertising the same, in the financing of housing in the provision of real estate brokerage services, in the appraisal of housing, or engage in blockbusting. Kaiser Assoc. strictly adheres to the National Association of Realtors© Code of Ethics and Standards of Practice in accordance with Federal Fair Housing Laws. "SILENCE IS CONSENT": As a multi-cultural office neither do we silently consent to nor do we tolerate any type of discrimination, racism or prejudice. We strive to listen and learn what needs to be done to implement permanent change. Site design + contents ©Tobias Kaiser 2024. PUBLICATION, USE OR REPRODUCTION incl. parts ONLY WITH WRITTEN PERMISSION. |

RSS Feed

RSS Feed