|

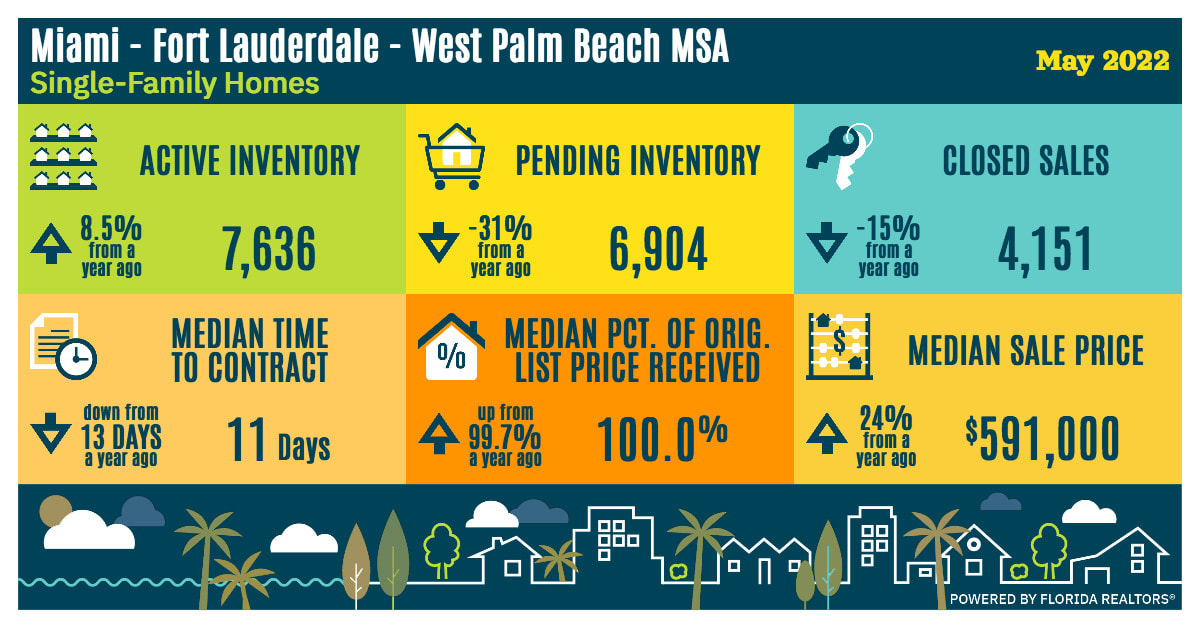

Finally our local housing market is becoming less insane. Far from normal, but less insane is progress. And the June numbers, available one month from today, will confirm that.

Here's a primer on how to read and interpret what is shown in the infographic above (all data for single family homes): ACTIVE INVENTORY: means number of single family homes for sale. In the Tri-County area (in essence the MSA or Metropolitan Statistical Area described above), this number should be north of 14k or 15k. But then, I didn't say we're back to normal, did I? At least the number is going up, caused among other reasons by rising mortgage rates and FOMO - Fear Of Missing Out. Those mortgage rates – and lack of reasonably priced inventory – caused a major drop in residential mortgage application: minus 32% compared to the same time last year. That in turn got sellers nervous, rushing to hop on the gravy train before it leaves the station. But, as I told a very nice prospective client from Hollywood who gets nudged by a neighbour to sell: if you don't move out of state, you have no business of selling. Even downgrading could cost the same, but with lesser quality housing. PENDING INVENTORY: properties in contract which haven't closed yet. Average time from signing to closing is at least three weeks for cash purchases, and easily double that with a mortgage. That number will likely not head north for at least another one or two months. CLOSED SALES: fewer homes for sale of course results in fewer closings. If pending numbers will take a month or two to stabilise if not go up, closings will take even longer. As an analogy, think of the turning radius of ships: a tug boat is nimble, a small freighter much less so, while a super tanker the size of the Exxon Valdez needs at least a mile to turn, rudder hard over. MEDIAN TIME TO CONTRACT: This is an interesting statistic we in the business call DoM or Days on Market. It means what it says: how many days was the property active until it went pending. 11 days is insanely fast, and I chose median on purpose, as average would have way too many outliers. Pre-covid, the number was typically in the 30s. MEDIAN % OF LIST PRICE: How much of what they were asking did the sellers actually get? In an overheated market as we had for the last 20 or so months, the median reached 100% in summer last year, dipped a bit and now is at 100% again since February. It means there were plenty of properties selling above list price - good for sellers if they moved away - however you will see that number decrease very soon. Typical is between 95% and 97%, meaning buyers negotiated between 3% and 5% off asking. As always, desirable homes have to be discounted less, while oddballs have to swallow the bitter pill (or "swallow the toad", as we say in German). Remember: it's not the seller who dictates the price, it's the plethora or absence of buyers who make the market. MEDIAN SALE PRICE: just what it says, the median of all 4,096 SFH sold in May. Important for you to frame the data: a healthy annual appreciation in a normal market in Florida hovers between 4% and 6% median. And: why median sales price? Answer: Because of the spread in our market; too many outliers which distort averaging. To illustrate – and bear with me, we're getting into a bit of research – I'll use homes currently for sale, and closed homes in May. For Sale: The lowest-priced SFH for sale today is listed at $60,000 (don't ask; you do not want to see it), the highest is $170m. The resulting average asking price of all homes listed today is $2,167,408, while the median price is $820,000. Neither $60k nor $170m is typical, but how many atypical listings do you eliminate? All four over $100m? The lowest four as well? Every month? Closed Sales: The lowest-priced home sold in May for $45,000, the highest for $49,500,000. The resulting average selling price is $999,922, the median is $595,000. With nearly 100% difference, do you see why in our market with super-expensive listings, only median price data make sense? In our housing market in South Florida the shift was caused by

If you're still reading: wow - thank you so much for your patience and interest! Feel free to post any questions or comments here, or contact me directly at 954 834 3088 or via email. Be well!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorTobias Kaiser works as an independent real estate broker and consultant in Florida since 1990. Always putting his clients' interest first, he specialises in modern Florida homes and architecture, as well as net leased investments. Archives

April 2024

|

- Home

- Modern Homes for sale

- Selling a Home

- Inquiries

- Why Tobias Kaiser?

- Contact

- "Modernist Angle" Blog

- Services we offer

- South Florida City Profiles

- Intro to Modernism

- Modern Styles explained

- Elements of Modern Architecture

- Preservation

- Real Estate FAQ

- Deutsche Seite >

- Net-Leased Investments >

- About Tobias Kaiser

|

|

KAISER ASSOC, INC • LIC FLORIDA REAL ESTATE BROKERS & CONSULTANTS

dba MODERN FLORIDA HOMES • 370 CAMINO GARDENS BLVD • BOCA RATON, FLORIDA 33432, USA TOBIAS KAISER, MSc, CIPS • REALTOR/BROKER • MODERN ARCHITECTURE SPECIALIST MEMBER NAR, RCA, DOCOMOMO, NCMH • EMAIL • (+1) 954 834 3088 ZERO DISCRIMINATION: Kaiser Assoc. and its agents will not discriminate against any person because of race, color, religion, sex, handicap, familial status or national origin in the sale or rental of housing or lots, in advertising the same, in the financing of housing in the provision of real estate brokerage services, in the appraisal of housing, or engage in blockbusting. Kaiser Assoc. strictly adheres to the National Association of Realtors© Code of Ethics and Standards of Practice in accordance with Federal Fair Housing Laws. "SILENCE IS CONSENT": As a multi-cultural office neither do we silently consent to nor do we tolerate any type of discrimination, racism or prejudice. We strive to listen and learn what needs to be done to implement permanent change. Site design + contents ©Tobias Kaiser 2024. PUBLICATION, USE OR REPRODUCTION incl. parts ONLY WITH WRITTEN PERMISSION. |

RSS Feed

RSS Feed